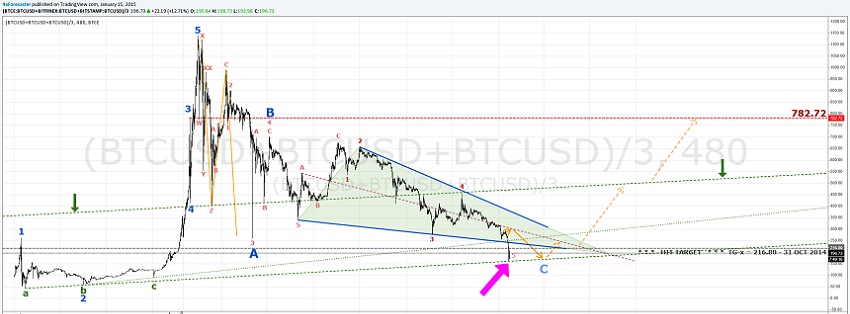

Silence before the storm – up or down?

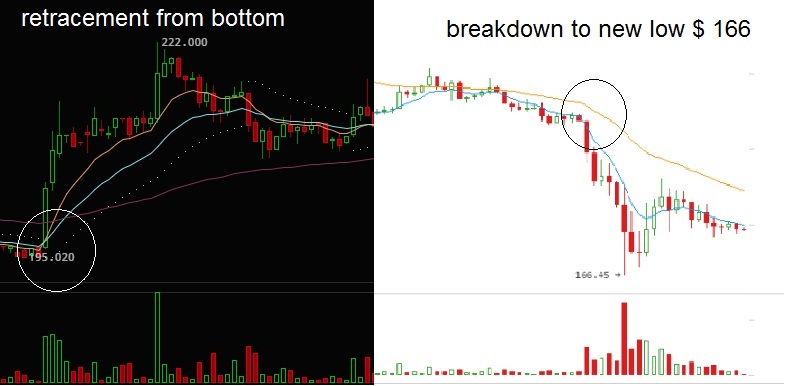

Last week, our forecasts proved true. After anticipating a break to fresh lows from $220 levels, Bitcoin markets surprised most by capitulating to an unexpected low under heavy volume – $165 low accompanied by significant volume (figure).

Volumes on exchanges were exceptionally high on capitulation to $165, marking a significant bottom. Just have a look at the size of sell of wick on 3-day candle chart – stopping volume at this price is visibly heavy.

Prices quickly retraced up to $230, a 30% profit opportunity on the long, and about 20% for $220 shorts. Retracements are common after such impulsive moves offering lucrative short term profits, however. Timing entry and exit is paramount.

Resistance at $230 forced the market back down to consolidate around $200. Triangle impending breakout patterns appear on 1H, 2H, 4H, 6H charts; following this prolonged sideways corrective price action, a break to either side is close to unfolding.

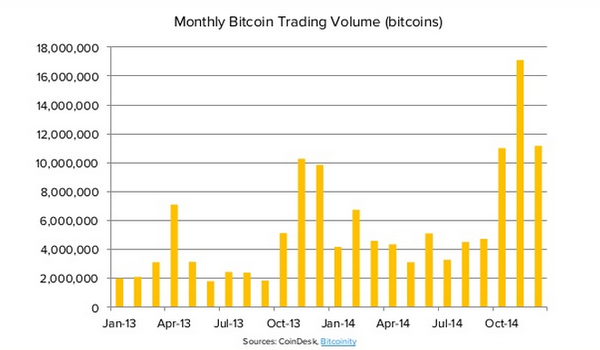

We are still in a long-term bear market, dating back to August. This long bear market was expected by traders since August of 2014, and tapers around the current prices we are experiencing. Despite drop in prices, volumes on exchanges have consistently been on a rise.

A chart showing monthly bitcoin volumes

On the 1 day, 3 day and weekly charts, signs of exhaustion from hammers and candlestick wick extensions. Huge price movements on short term intervals are nothing more than bleeps on 3 day charts. Bar your trading style, mid-term traders wait for short-term prices to consolidate and dictate price direction on 1D, 3D and 1W charts. Focussing on minute charts comes with anxiety

Bitcoin Fundamentals

This week bitcoin was trumped as the most volatile currency by the Swiss Franc (CHF)! Markets dropped by 30% value after an unexpected price plug pull by Swiss National Bank. Stunned by SNB actions, investors on European crypto exchange, Kraken, shot up prices on this news!

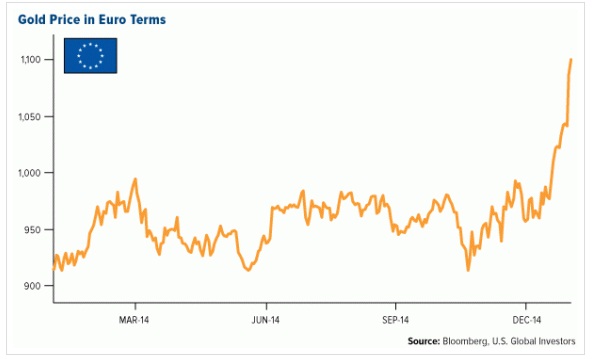

Meanwhile, the price of gold broke out into new 5 month highs across worldwide currencies. With an ounce of gold priced at above $1,300, speculation on capital flight into gold from fiat currency may bode well for bitcoin if the market favors it as a safe asset class.

“With gold near $1,300 – 5-month highs and silver topping $18 – 4-month highs; it appears investor demand for non-fiat currency is growing (and not just for China and Russia)” – ZeroHedge

The North American Bitcoin Conference(TNABC) kicked off on 17 January, attracting huge attention on core development of Bitcoin & blockchain applications. In attendance, notable startups included – Ethereum, Tether, BitGO. The development of Bitcoin [protocol] adds to the value of bitcoins, in my opinion. Miners earn fees in bitcoin which means the more the network gains utility, the more valuable this ‘token’. 2015 was unanimously highlighted as a significant year for bitcoin; a similar tone echoed by bitcoin investment analysts.

Finally, Coinbase wrapped up a $75 million round C seed funding from most notably the NYSE:ICE (New York Stock Exchange). In a press release, President Tom Farley, referenced bitcoin as a new asset class. On twitter, the official NYSE handle tweeted

“We will work with Coinbase to bring additional transparency to bitcoin pricing”

All this coupled with an impending bull return makes for an exciting 3 months. This week’s forecast lines up with the timing of bullish 2015 remarks.

Week’s price forecast

I will be the first one to admit there is a bullish undertone amidst speculators. Cautious traders, however, are expecting another dip at a low bottom. This chart reflects a palpable uncertainty that could easily break to either side. One thing is for sure, all these prices (sub $300) are a good entry price for an 8 month hold strategy with at least 77% to be gained.

Right now, my counts indicate movements up (and down) have been of corrective structure ever since $166 bottom, which seems to support a consolidation scenario here before resumption of bear trend. The market has now cut below Bollinger Bands for the second time, coupled with a MACD bearish hook.

“All that said, the above is an indication that the correction is losing steam, in the form of weakening downside momentum/volume, while price plows ahead to new lows. Which signals that we’re getting nearer to the end of the (2013)-2014-(2015) bear market.”

Still, this rise so far seems corrective so we should expect one more down, although given how far up the 4th went I wouldn’t be surprised if 5 will be truncated/double bottom.

Our proximity to the bottom now precedes a run up to at least +500. A move that will have enough momentum and strength to break past $474 – high. This chart (by @4XForecaster) illustrates expected levels.

Remember, weekly indicators take a lot of time to move. There will be many fluctuations until market moves back into bullish territory. All that is needed now is a little patience. We will get there. It will come, and it will be glorious.