In the wake of our Q4 2022 COMPASS report, the CEX.IO Market Research Team circled back to one of the document’s main discoveries to unpack its layered complexities. By tracking historical trends and parsing on-chain data, the Team was able to discern the human machinations behind Bitcoin’s steady resilience. Namely, that the asset’s core infrastructure and programming are continuing to enable Bitcoin’s success 14 years later. Even as uncertainty lurked across multiple sectors, participants continued to HODL all denominations of BTC, cementing signs of dedication and vigilance among the community.

Now, in the latest edition of our COMPASS series, Q1 2023 revealed a new set of use-cases for Bitcoin’s network architecture, and even constituent parts of the asset itself. An ecosystem aimed at minting and managing NFTs on BTC satoshis is providing new avenues for the storage and production of digital art. These clever reimaginings help maneuver data onto the network’s immutable ledger, and enjoy the robust security protections offered by Bitcoin’s proof of work consensus mechanism.

If you haven’t read our past two COMPASS reports, or the ruminations that followed, now is a great time to get caught up. Since our founding, we’ve always worked to scaffold the crypto knowledge we share with our participants. In fact, like many of the solutions we highlight across our educational resources, this is often required when building a new vision of the future. To take this and our prior analogy further: if Bitcoin is a house with “strong bones,” it appears the asset has welcomed an addition, and some new neighbors.

Not your ordinary satoshis

Despite the rush of development within the Ethereum ecosystem thus far in 2023, Bitcoin has kept pace, and continued to surprise and innovate its corner of the digital economy. One way this has occurred is through the emerging use of modified satoshis to move Bitcoin into the NFT space. Currently, this can be achieved by using two interlocking methods that often get thrown around interchangeably, known together as Ordinal Inscription. However, we hope to shed some light on, and differentiate these key steps in the process, by nestling them into familiar, real-world actions.

Arguably the more high-profile of the two, ordinals come with their own subset of theory that lays out the process for customizing the fungible design of an individual satoshi. Sat for short, these are the smallest units of BTC, representing one-hundred-millionths of the flagship asset. Much like the serial numbers printed on most fiat currencies, Ordinal Theory is used to assign a similar coding system to satoshis in the order they were minted. If it helps, imagine a penny or cent piece that now has a unique marking that helps set it apart.

Next comes the inscription. This refers to the process of inscribing or stamping data (an image, video, etc.) directly onto that now-numbered satoshi. As long as the file in question aligns with the network’s parameters for available block space, that data will be time stamped and added to the ledger. Now, this individual satoshi is both non-fungible and contains data backed by the trustless capabilities of a blockchain network: two key components necessary to mint an NFT. To return to our penny or cent, imagine it’s been smashed and elongated like a commemorative souvenir from a museum or attraction. But in this instance, the asset’s uniqueness is preserved through its number, courtesy of Ordinal Theory.

This one-two punch was an unintended benefit of the Taproot soft fork that went live in Fall 2021, which bundled transactions to conserve block space, and accelerate efficiency. Additionally, Taproot unlocked expanded script writing capabilities for the “witness section” tasked with housing signature data within a Bitcoin transaction. By building off the network’s prior SegWit upgrade, which introduced witness sections and expanded block size to 4MB, files under that threshold could now be inscribed into the signatures of individual satoshis. If this sounds complicated, command- or right-click any file on your computer, select the equivalent of “Get Info,” and imagine storing a media file in the resulting view.

Like many developments in the crypto space, blockchain visionaries are often most well-known by their social media handles. @rodarmor is credited with building the open-source ordinal project on Github, and driving its progress with regular updates to the burgeoning field of study. In practice, both Ordinal Theory and the process of inscription have led to massive increases of activity on the Bitcoin network as new and existing users flock to participate.

Ordinal Inscriptions: By the numbers

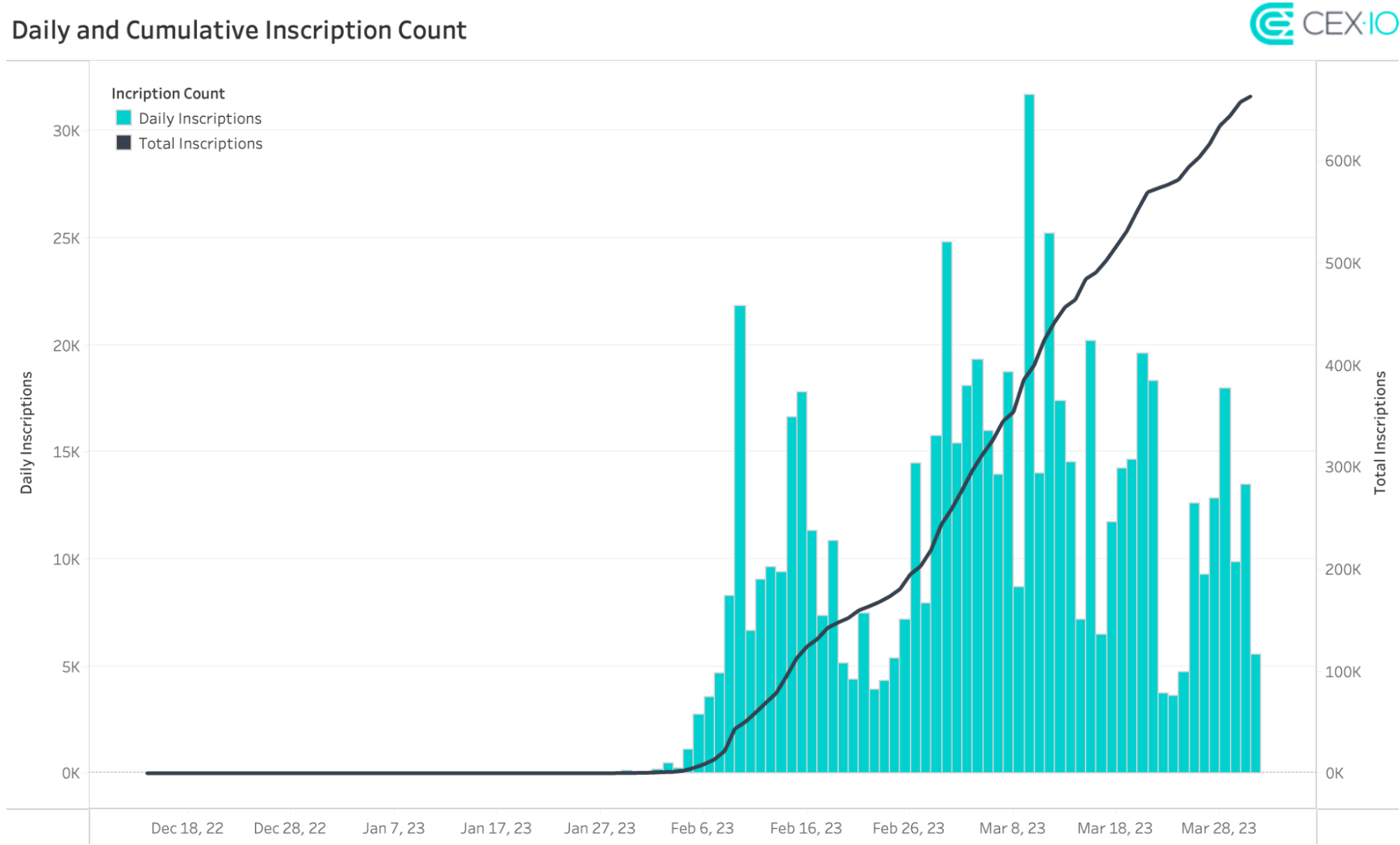

Crypto long established a reputation for moving quickly, and this latest explosion of activity around ordinals is yet another data point to reference. To recap, our Q1 2023 COMPASS report tracked the emergence of the trend, and clocked its momentum moving into spring. At that time, the CEX.IO Market Research Team discovered that over 663,000 total inscriptions were minted in Q1 2023, with 420,000, or 63%, created in March alone. While the Team had less than two months of transactions to analyze, the pace of development was encouraging. As it turns out, this parabolic rise proved to just be in its infancy.

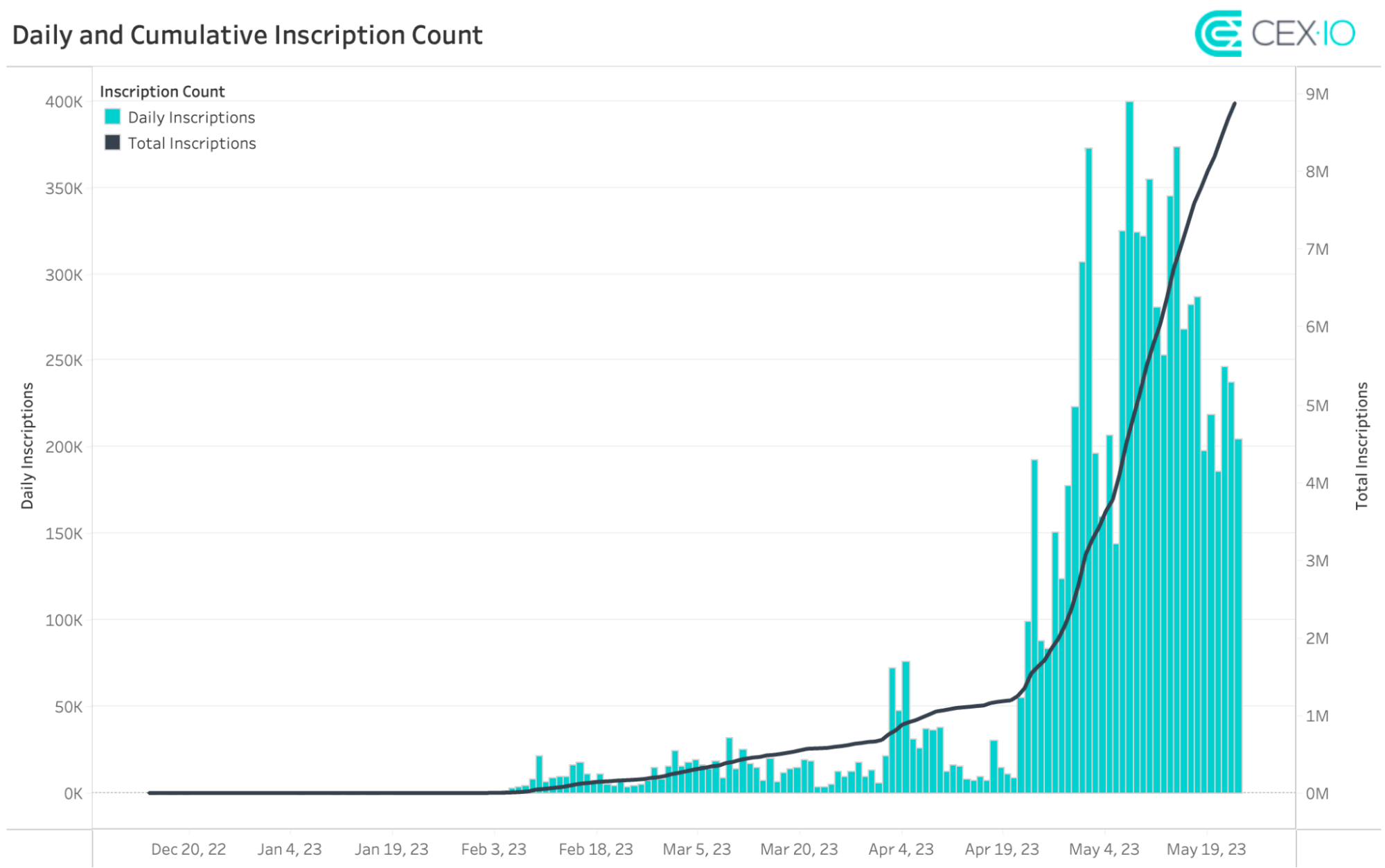

Since our coverage of Q1, interest in this sphere has practically gone vertical, with prior charts looking unrecognizable in the current landscape. At the time of this writing, the total number of ordinals now is roughly 8.8 million, which represents an increase of over 1300%. To put this another way, nearly the same number of inscriptions were minted on May 7 than March’s cumulative total, give or take a couple thousand. Although ordinals are still a nascent corner of Bitcoin’s ecosystem, and one that will require close attention to diagnose the potential of a bubble, this level of progress is astonishing.

Below we’ve reproduced images from the Q1 2023 COMPASS report, and placed them alongside present day renderings to illustrate this phenomenon:

Q1 2023 COMPASS overview of ordinal inscriptions. Source: Dune

Daily and Cumulative Inscription Count. Source: Dune

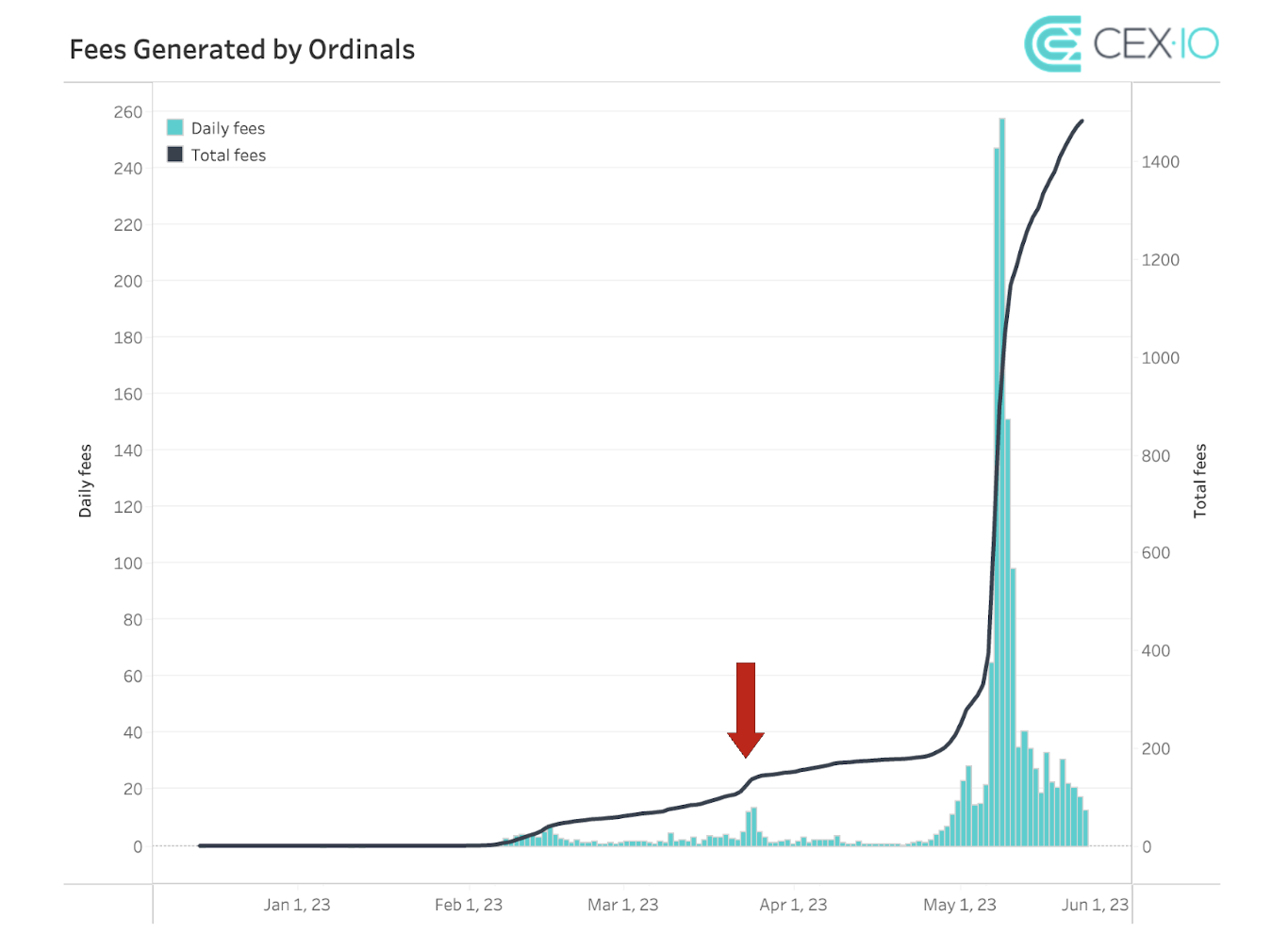

The rapid doubling of inscriptions has also sparked a precipitous increase in fee revenue. When we left off in our analysis of Q1 2023, total fees amounted to just shy of 152 BTC, which breaks down to an average of roughly 1.7 BTC per day. Once again, this number has grown significantly. At present, fees for ordinal inscriptions amount to around 1,480 BTC in total, and are continuing to climb. On average, this amounts to roughly 10.3 BTC per day, for an increase of 605 % in total. Once again, the value generated through these actions is signaling a new frontier for participants at each end of these transactions. This is proving advantageous at a time where miners have been experiencing progressively leaner outcomes. However, alternative use-cases for Bitcoin and its legacy network are causing some to vie for attention to halt this evolution of the asset’s community. Ideological beliefs aside, the chart speaks for itself:

Fees Generated by Ordinals YTD. Source: Dune

This exponential growth makes it difficult to spot our original snapshot from this new vantage point (the red arrow above). Such images call to mind the disruption typically reserved for tectonic activity, where forces buckle the Earth to comport with a fresh vision. In Bitcoin’s similarly finite system, one is right to conclude that equal and opposite reactions must occur in both spaces. When plates plunge under the Earth’s surface, and mountains are formed, the jutting mass can create new weather patterns, and even divert or encourage rainfall. Coincidentally, a similar rift is playing out among the Bitcoin community. While many are clearly embracing ordinal inscription, some concerned parties worry these new use-cases will affect what some believe to be the asset’s primary function: money.

Debating Bitcoin’s hidden gallery

In truth, ordinal inscriptions are not Bitcoins first foray into the art world. Over the years, several Bitcoin-native NFT projects have launched to varying degrees of success. However, the breadth and relative ease of these new novel technologies appear to be overshadowing prior attempts at revolutionizing Bitcoin’s versatility for storing, accessing, and sharing information. This is perhaps best encapsulated by reporting from Blockworks in February 2023 which announced the addition of classic video game DOOM to Bitcoin’s immutable ledger. For a mere 31.2 KB, a cloned and somewhat rudimentary version had been inscribed as an ordinal, and was now available to anyone with access to the chain. While the graphics leave something to be desired, the reality of this achievement alludes to incalculable potential.

It should be no surprise these traits have continued to act as a flywheel for curious participants to put their own unique spin on an atom of BTC. Since time immemorial, humans have loved collecting and squirreling away pieces of cultural ephemera. And yet, this seemingly innocuous practice has rehashed (pun intended) an age-old debate surrounding the correct usage of the flagship network. Many critics (including Satoshi Nakamoto, the anonymous creator of BTC) have been vocal over the years about their desire for Bitcoin to remain dedicated to financial transactions. For them, this is the asset’s intended purpose, and deviating would only contribute to a more bloated, less functional currency. However, closer examination of these claims reveals an underlying conservatism that fails to acknowledge the benefits these present innovations have rendered thus far.

For one, the fees we discussed above are being distributed to miners as added incentive for their contributions to the network. As the chart indicated, these are not small sums. This is especially critical at a time where rewards are beginning to diminish relative to the energy required for their discovery. With another halving event looming in April 2024, this problem is only expected to worsen with time. This fact alone should have purists reconsidering the viability of ordinals as a way to circumvent a potential dimming of the network. If the rate of ordinal exploration and adoption continues, the Bitcoin community could see a more robust response from miners lining up to power these actions.

Another common criticism of ordinals inscriptions is their impingement on BTC’s fungibility. The thinking here is that once inscribed, users would have no incentive to swap the unique satosis. Imagine receiving a sat from a friend that contained a meme or inside joke: who would part with that? With enough similar events occurring, critics worry this could result in increasing larger sums of BTC being removed from circulation. While this line of thinking is compelling, it is also incongruous with how people behave in the real world.

Visit any bar, restaurant, coffee shop, or retail business and there’s a good chance a bill will be hung on the wall to commemorate their first sale. In addition to our aforementioned penchant for crushing coins into novelty keepsakes, jewelry and other ornate accessories are also common second acts for currency. If anything, championing ordinal inscriptions would be aligned with humanity’s long-standing tradition of embellishing money. Clever readers are right to wonder how this can be advisable when just moments ago we acknowledged BTC to be a finite resource. But even a limited amount can still result in a huge number. And unlike faded banknotes behind a register, satoshis can be accessed from anywhere that receives a connection.

NFT with a pedigree

While there are key differences between ordinals and other related projects, the most pervasive boil down to their intuition and operational elegance. Where NFTs can be built on a variety of platforms, and encoded into a spectrum of smart contract configurations, ordinals share uniformity backed by Bitcoin’s aggressively hashed network. Not only does this make it easier to locate individual data points, think DOOM, but the renewed activity is helping to bolster security through those increased miner rewards. This is sparking new conversations around Bitcoin’s potential to archive files, and showcase digital art within its immutable transaction data.

Given this recent boom is the combined result of two subsequent upgrades, there’s genuine cause to believe the community will continue to drive success with these innovations. Like all mysterious forces, creativity ebbs and flows, but palpable excitement appears to be reigniting that energy in the crypto space. Unlike previous projects that offered solutions for the creation, storage, and authenticity of digital art, the developments around ordinal inscriptions solve for the dilemma in each category. By building off the sound structure of Bitcoin’s network, and repurposing fractions of BTC, we’re observing a sea change in the diversification of the asset’s applications. Plus, as the sector evolves with new functionality, snippets of culture will continue to be absorbed onto Bitcoin’s network, and made forever available to those who know where to look.

Note: Exchange Plus is currently not available in the U.S. Check the list of supported jurisdictions here.

Disclaimer: Information provided by CEX.IO is not intended to be, nor should it be construed as financial, tax or legal advice. The risk of loss in trading or holding digital assets can be substantial. You should carefully consider whether interacting with, holding, or trading digital assets is suitable for you in light of the risk involved and your financial condition. You should take into consideration your level of experience and seek independent advice if necessary regarding your specific circumstances. CEX.IO is not engaged in the offer, sale, or trading of securities. Please refer to the Terms of Use for more details.