When a house shows durability, we say it has “strong bones” in a nod to its well-conceived design. Each piece (foundation, walls, roof) fits together to form a stable, lasting structure. It’s in this combination that we’re able to assess the pros and cons of a home’s function and existence: will it require excessive maintenance? Is the basement in conflict with the surrounding earth? If the wind picks up, will there be anything left standing? Crypto enthusiasts have come to approach Bitcoin’s skeleton with a similar set of questions in an effort to track its progress. And what they’ve found is that over time, the digital currency has continued to show robust, lasting health.

In the 14 years since its debut, Bitcoin has displayed longevity in a space not exactly known for its perennial nature. Many factors have helped contribute to its success, but one main advantage lies in the intelligent inner workings of BTC’s network architecture. Just as a building derives its strength from a tactful blueprint and diligent upkeep, Bitcoin enjoys analogical benefits from both its internal programming and the attention of a fervent, dedicated community. These forces helped set a precedent for what would become decentralized finance (DeFi), and inspired myriad innovative solutions to break ground in its wake.

But not all projects are created equally. Similar to how gold wiring or copper pipes can extend the equity of a home, Bitcoin’s high caliber programming informs the value and integrity of its network performance. Where countless new technologies have sought to replicate BTC’s meteoric rise, few have captured the primordial asset’s core elegance. Built on clockwork tokenomics, distributed resource allocation, and ever-mounting security, these features reinforce the underlying infrastructure that remains the key to Bitcoin’s endurance.

By examining diagnostics across market highs and lows, factors like block intervals, hash rate, and reward discovery help paint a more complete picture of Bitcoin’s success on a macro level. To help us get where we have to go, let’s start by setting the table.

Blocks form the foundation

From its inception, Bitcoin was conceived as a system that would operate outside, and independently of, traditional finance. Its peer-to-peer nature defies centralization, and allows each node to act as a standalone entity, containing an immutable record of the entire network’s transaction history.

However, nodes are incentivized to work in concert. They provide the critical function of verifying valid transactions, and weeding out bad actors who attempt to cheat or harm the network. In short, nodes enforce accountability.

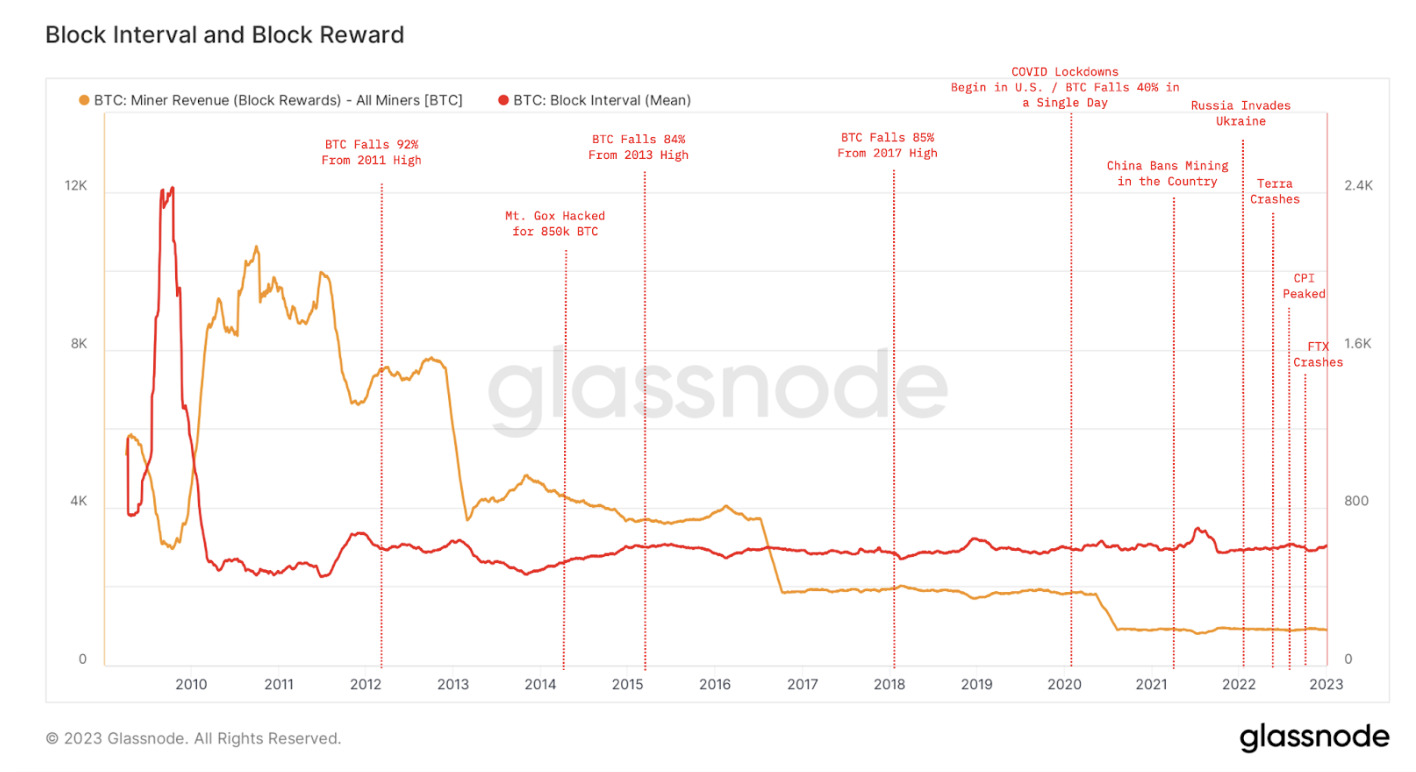

This decentralized arrangement is held in alignment by the network’s proof-of-work protocol, which rewards consensus through the allocation of fees and newly discovered BTC. With the mining of each new block, a fresh batch of transactions are confirmed and added to the network’s digital ledger. In essence, this amounts to Bitcoin’s cemented monetary policy, the consistency of which is listed in the chart below.

Halving events help curtail issuance and ease inflationary pressure. Image courtesy of Glassnode. Participants called miners do the heavy lifting of

Halving events help curtail issuance and ease inflationary pressure. Image courtesy of Glassnode. Participants called miners do the heavy lifting of

Participants called miners do the heavy lifting of contributing the computational horsepower required to mine blocks. When BTC changes hands on the network, nodes collect fees and pass along the data. As transactions accumulate, miners compete to confirm their validity and mint new blocks of data. This requires computing power, or hash, generated from physical hardware.

As machines race to solve complex math problems, the “hash rate” can be measured as the number of guesses submitted per second by a miner, or collectively across the network. The winner who supplies the correct answer is rewarded with freshly minted BTC delivered to their wallet address.

However, network parameters help establish guardrails that dictate a strict discovery rate of 10-minute/600-second increments, regardless of available computing power. This is one of the methods Bitcoin employs to self-regulate its internal tokenomics.

Rules keep the network up to code

Bitcoin maintains its good health in large part because of the strict parameters that govern its operation. Famously capped at approximately 21 million units, BTC is a finite resource. In turn, the network’s issuance is cut in half every 210,000 blocks, or roughly every four years, at so-called halving events. These work as built-in stop gaps to help ease inflationary pressure by diminishing the release of new coins into circulation. The year 2140 is identified as when the final fraction of BTC would finally be uncovered. Ever-slowing issuance coupled with the 10-minute pace required for new blocks, and therefore, fresh BTC, work in tandem to restrain the network and inconvenience the baser side of human self-interest.

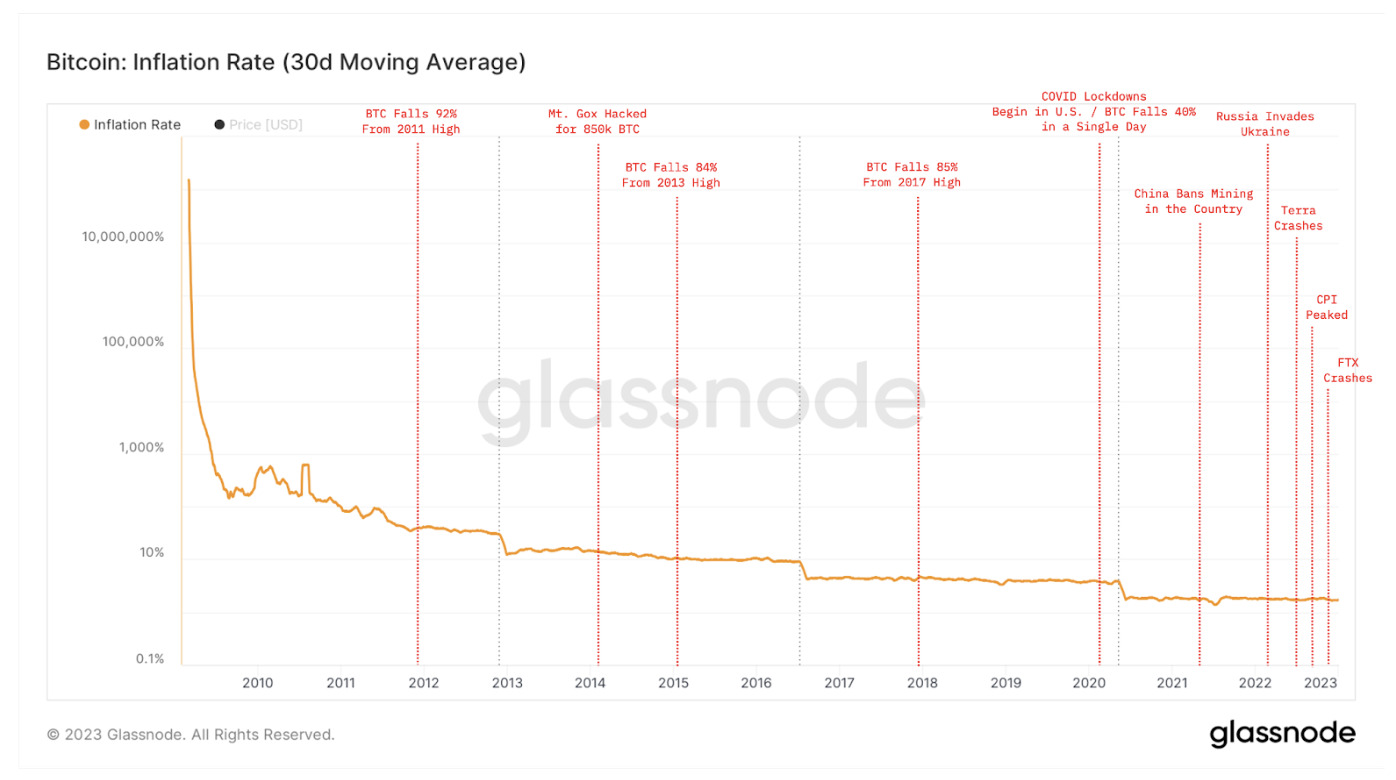

Bitcoin’s 30-day moving average shows a stable response to inflation. Image courtesy of Glassnode. Since a host of far flung nodes combine to form the Bitcoin ecosystem, online hash reflects the sum total of all computing power backing the network at any point in time. Internal protocols respond to this available energy by determining a difficulty level that will ensure block formation moves along at its network mandated 10-minute pace. This sliding scale ensures that mining can continue even if a large number of miners are suddenly taken offline. Additionally, the hash rate helps illustrate the mounting force that would need to be counteracted to execute a successful 51% attack against the network. A steadily climbing hash rate means an increasingly high level of security.

Bitcoin’s 30-day moving average shows a stable response to inflation. Image courtesy of Glassnode. Since a host of far flung nodes combine to form the Bitcoin ecosystem, online hash reflects the sum total of all computing power backing the network at any point in time. Internal protocols respond to this available energy by determining a difficulty level that will ensure block formation moves along at its network mandated 10-minute pace. This sliding scale ensures that mining can continue even if a large number of miners are suddenly taken offline. Additionally, the hash rate helps illustrate the mounting force that would need to be counteracted to execute a successful 51% attack against the network. A steadily climbing hash rate means an increasingly high level of security.

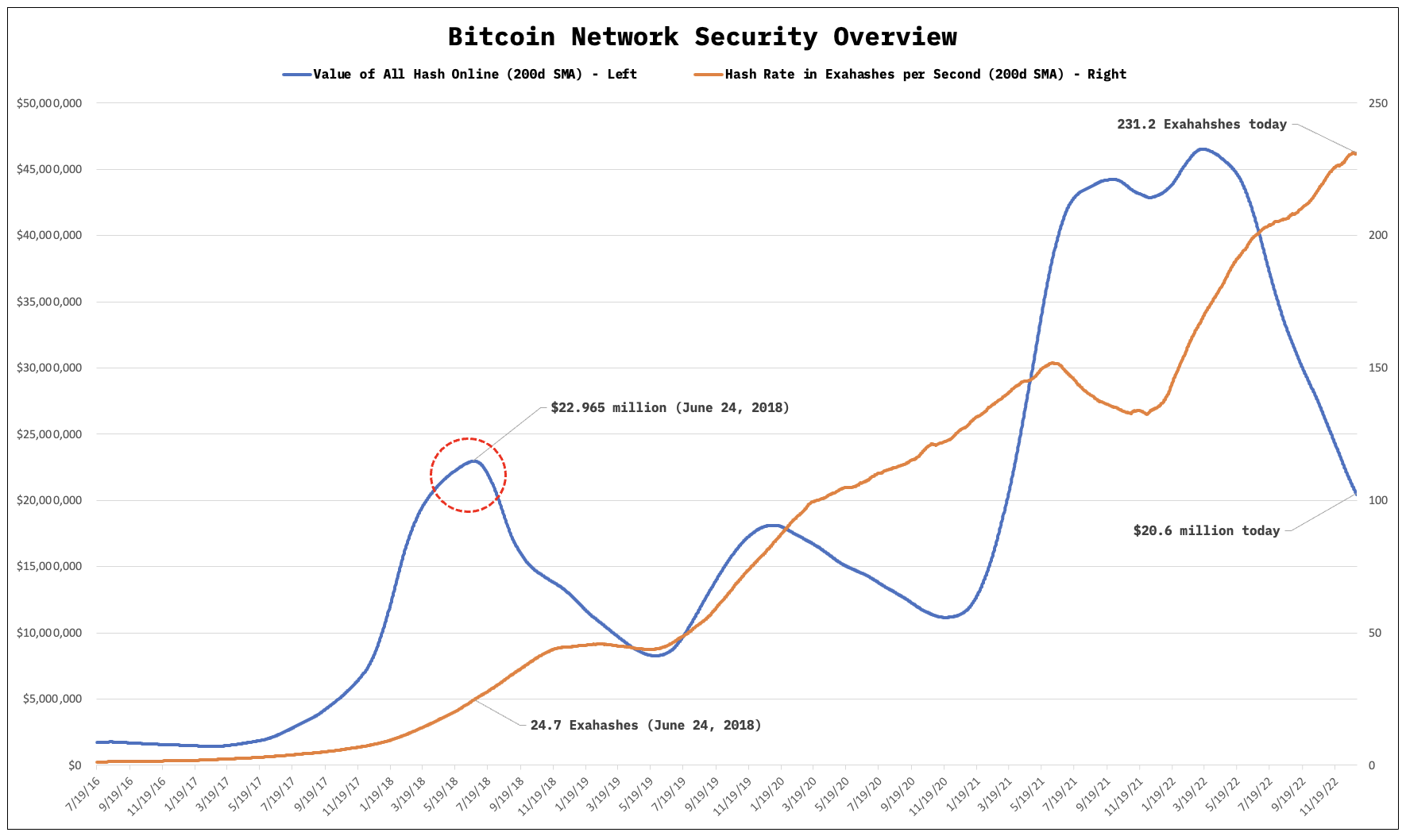

This is achieved when considering the sheer volume of machines necessary to produce the energy required for such a gambit. The monetary investment in BTC needed for network participation may be obtainable for a deep-pocketed, would-be supervillain. However, the infrastructure in mining rigs and the energy required to get them all online presents an insurmountable barrier. While it would theoretically only cost roughly $21.3 million to acquire the equipment, finding and launching the equivalent 2.5 million machines is a near tactical impossibility to house, let alone operate. By dissuading such miners from attacking the network with an ingenious counterweight, harmonious exchange is able to prosper. This aids in overall network decentralization, and helps Bitcoin function as a self-contained, “trust-less” economy.

Hash exists independent of value. Its rise contributes directly to network security. Image courtesy of Glassnode.

Hash exists independent of value. Its rise contributes directly to network security. Image courtesy of Glassnode.

What the numbers show

As the network has grown and developed, Bitcoin has demonstrated secure patterns consistent with having an expanding base of active participants. This is reflected across an array of factors accessible through on-chain analytics. Tracking BTC discovery and block creation over the past few years reveals that, despite both bear and bull markets, and the occasional black swan event in the broader ecosystem, core network functions remained steady.

In 2021, an average of 902 BTC was discovered per day, and ticked up to 910 BTC per day the following year (today the target rate is 900; at the next halving event, the target daily rate will drop to 450 BTC). As the charts in this post indicate, the network was undeterred. This is reinforced by the fact that daily block intervals for those same years managed to tighten despite larger economic and geo-politcal events. Bitcoin’s average daily block interval hovered around the 600-second target by measuring 610.96 in 2021, and then becoming more efficient in 2022 with a rate of 598.66. Alongside the rising online hash rate, these figures help depict a network capable of weathering a variety of external forces.

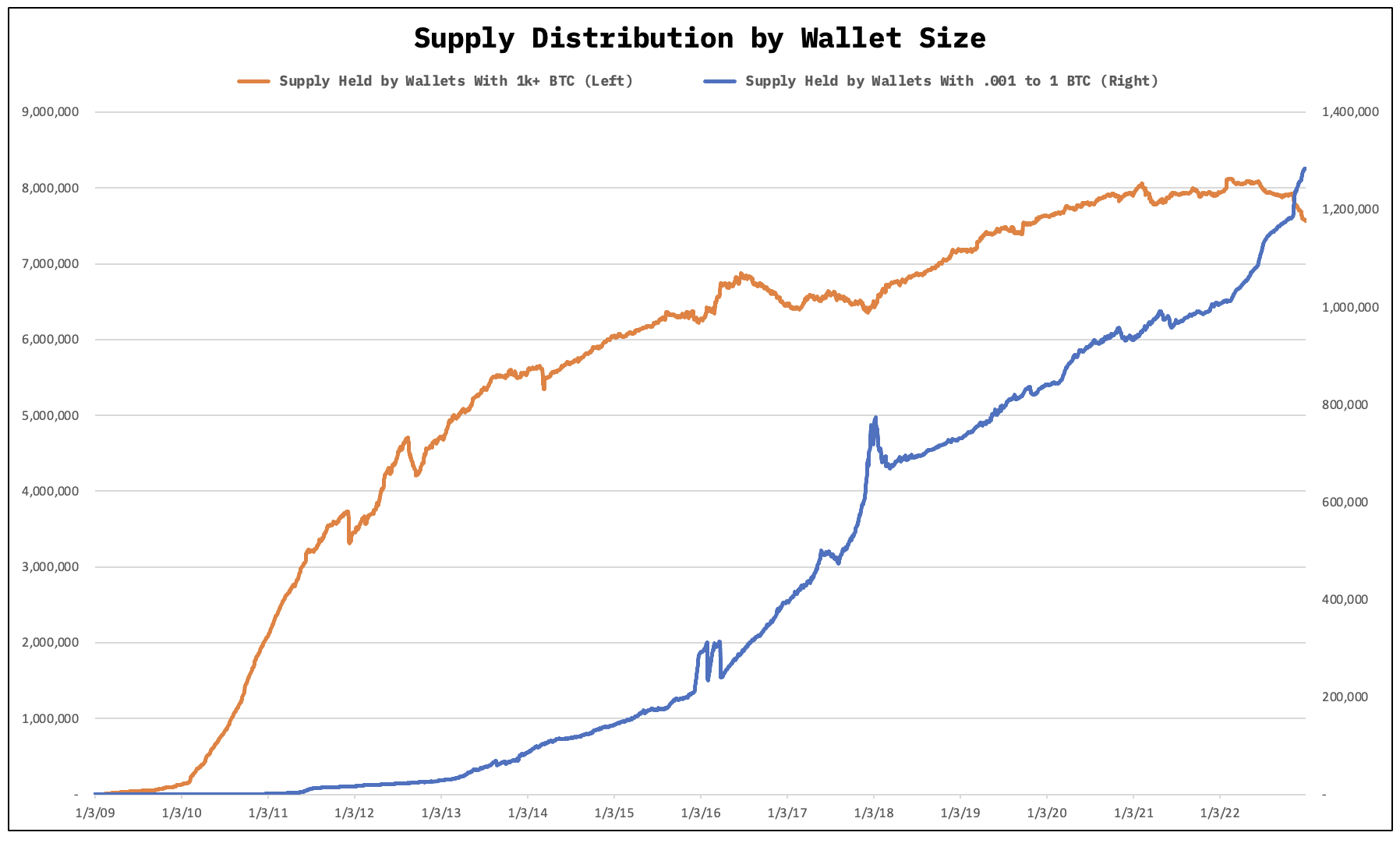

Another factor that suggests strong network support is the relationship between high and low value holders. In 2022, for the first time in the asset’s history, the total value held by wallet addresses that contain 0.001 to 1 BTC is increasing. Simultaneously, the combined amount held by participants with 1000 BTC or more is on the decline. What this reveals is that in light of events that transpired in and around the crypto ecosystem, Bitcoin has continued to attract new, smaller denomination users, resulting in overall community growth.

The increased valuation of BTC down to the decimal level highlights two success stories that could foretell wider crypto adoption. The exchange of these partial values argues for the effectiveness of the network’s core functionality to tackle matters like inflation. Additionally, now that Satoshi’s white paper has moved past the theoretical phase, the general public is more receptive to the parallels Bitcoin shares with precious metals, such as gold.

For the first time, more BTC is being held by lower value (.001 to 1 BTC) participants. Image courtesy of Glassnode.

For the first time, more BTC is being held by lower value (.001 to 1 BTC) participants. Image courtesy of Glassnode.

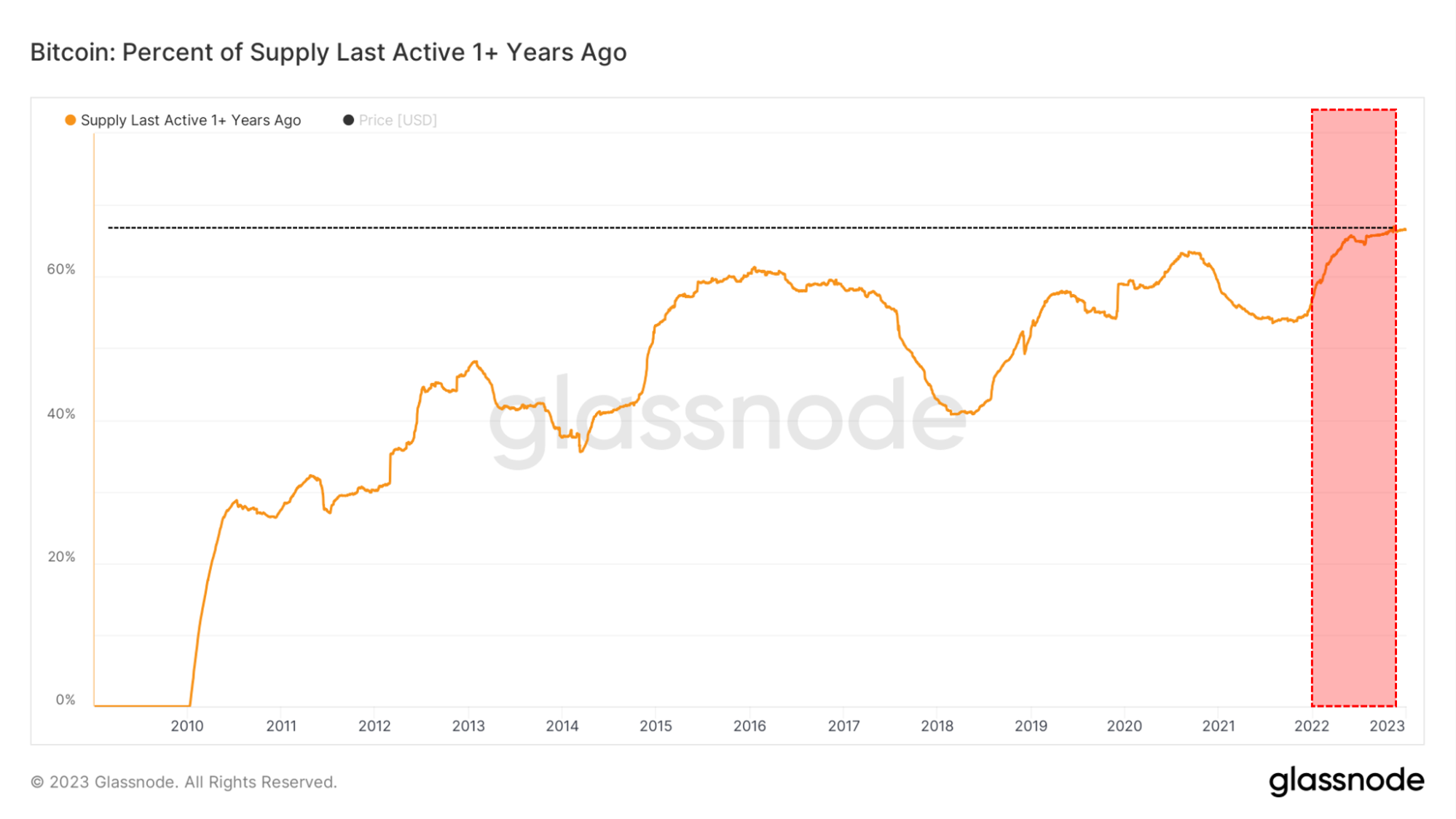

Going hand-in-hand with the ubiquity of smaller users, Bitcoin’s network reached another milestone in 2022 by having the highest percentage of its supply value active in the last year. After surpassing its previous record of roughly 67%, usage could continue marching upward if these trends continue. Another dimension of this data is that BTC is continuing to see more causes for exchange. Shifts in consumer spending, like the rise of the sharing economy, have invited individuals to purchase goods and services from within their communities through a variety of means. Implicit in these data points is the realization among users that, unlike a third-party banking app, transacting with Bitcoin allows for direct peer-to-peer payments. While the asset continues to get most of the fanfare from sheer popularity, closer examination reveals the intricate balance of forces that constitute its growing appeal.  Early signs are showing 2023 could be BTC’s most active year to date. Image courtesy of Glassnode.

Early signs are showing 2023 could be BTC’s most active year to date. Image courtesy of Glassnode.

Note: Exchange Plus is currently not available in the U.S. Check the list of supported jurisdictions here.

Can’t put a price on home

There’s a common misconception that Bitcoin’s value derives solely from its worth. That to rise or fall in the markets is to face success or failure. In reality, this is a shortsighted assessment. Bitcoin’s tokenomic stability and network security are critical to its graceful operation. Namely, without these foresights and precautions woven into the network’s DNA, there’s no guarantee it would have seen the same favorable outcome. Rather, when we argue the relative merits of how Bitcoin can or should fit into the wider investment landscape, it’s important to distinguish between its shifting monetary value as an asset versus its potential as a monetary system itself. As we can see from a variety of vantage points, Bitcoin’s advantages and relative use cases are becoming more clear with each passing transaction.

For more detailed information on Bitcoin 14 years later, and the state of the crypto ecosystem at the end of Q4 2022, read our latest COMPASS report.

Disclaimer: Information provided by CEX.IO is not intended to be, nor should it be construed as financial, tax or legal advice. The risk of loss in trading or holding digital assets can be substantial. You should carefully consider whether interacting with, holding, or trading digital assets is suitable for you in light of the risk involved and your financial condition. You should take into consideration your level of experience and seek independent advice if necessary regarding your specific circumstances. CEX.IO is not engaged in the offer, sale, or trading of securities. Please refer to the Terms of Use for more details.