After acquiring a new skill, it can be easy to forget the hardships that existed prior to expanding one’s knowledge. That period of struggle when the challenges of learning something viewed as second-nature, such as language, seemed insurmountable. What did the world look and feel like without that internal voice providing meaning to sounds and symbols? For many, engaging with the financial world elicits a similar response: a slurry of difficult concepts and jargon that’s out of reach for all but the initiated.

That’s why, honoring the conclusion of Financial Literacy Month, the CEX.IO Market Research Team put together a helpful guide to de-mystify some of the products and services available in the crypto ecosystem. Too often, a functional understanding of one’s financial potential stops after basic bank, savings, and retirement accounts are discussed. However, this side steps the spectrum of legacy and emerging verticals that are becoming increasingly intuitive, and more accessible for curious market participants.

Knowing the basics of how to manage, save, and have fun with your hard earned funds is paramount to planning a successful future. Read along as we explore some of the many ways to navigate the digital asset space, and gain a better understanding of the current financial landscape.

The verticals of financial literacy

From a traditional perspective, there are four verticals commonly associated with financial literacy. The components that intersect with crypto include:

- Earn

- Save

- Protect

- Spend

Separately, each grants unique opportunities. However, striking a balance between them can lead to sounder judgment and leave you better equipped to take full advantage of opportunities as they emerge in the digital economy. Let’s jump in!

Earn

Relative to crypto literacy, this principle encapsulates all the ways you can put your digital assets to productive use. Depending on the cryptocurrencies you hold, your appetite for risk, and level of familiarity with the digital economy, there are a number of avenues to choose from. Among the most popular is Staking.

Staking

Networks with proof of stake (PoS) consensus protocols enable you to “stake” the blockchain’s native token in exchange for periodic rewards. By pledging assets to the network through staking, users can contribute to the machinations behind processing and executing on-chain transactions. Unlike mining, which can require complex hardware and upfront capital, staking often has lower required minimums, making it more attainable for curious users. This broader participation also helps fortify security by further decentralizing the network, which strengthens its resilience to potential bad actors. Staking rose to stardom in the 2020 to 2021 bull run, and experienced another resurgence when the second largest blockchain network, Ethereum, migrated to PoS in September 2022.

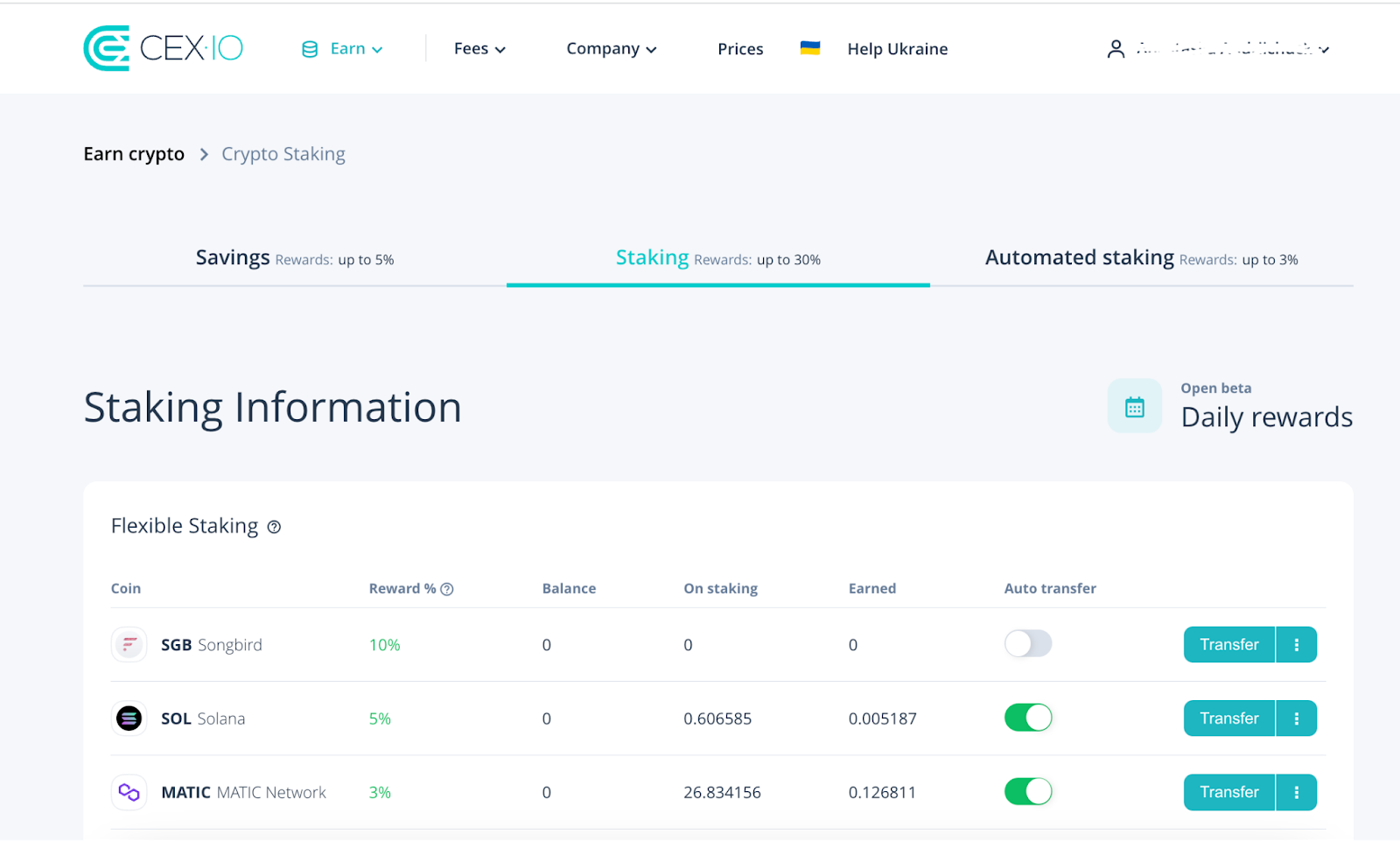

Digital assets can be staked through a variety of channels such as:

- Custodial staking through vetted, centralized platforms, like CEX.IO. Please note, staking has geographical restrictions and is not available for CEX.IO users in the United States.

- Delegating coins directly to a validator through a decentralized, web3 wallet.

- Choosing a liquid staking provider on a participating blockchain or platform (these can be centralized or decentralized.

Due to the evolving regulatory landscape around this practice in some jurisdictions, geographical restrictions can persist across staking channels. For example, staking is not currently available for CEX.IO users located in the United States.

Understanding the instruments you have at your disposal is critical to making the most of this pillar of literacy. This includes comprehending the source of earning, in this case rewards, and how they function in a healthy network ecosystem. Having a solid grasp of where rewards come from can help you better identify possible risks or opportunities that could affect your strategy. No matter which option you choose within this vertical, knowing how something works is the first step to making it work for you.

Where do staking rewards come from?

Staking rewards are the result of new supply issuance, and in some cases fees generated by a network. Potential rewards are calculated proportionally to the amount staked of a network’s native token, and relative to the participation rate, or the total amount of the asset currently being staked. In principle, these two metrics interact to balance the internal economy of the network. However, it should be noted that overtime this can result in the dilution of on-chain value as a byproduct of traditional inflation.

For example, imagine theoretical cryptocurrency A has a supply of 100 units today, and adds five new units on a daily basis through staking rewards. The five new units are divided up among staking participants proportional to the amount of the theoretical asset they stake, and join the circulating supply. Therefore, as more coins are staked, and the participation rate increases, reward issuance will decrease in an effort to balance the network, and vice versa.

Note: CEX.IO Staking is currently not available in the U.S.

Save

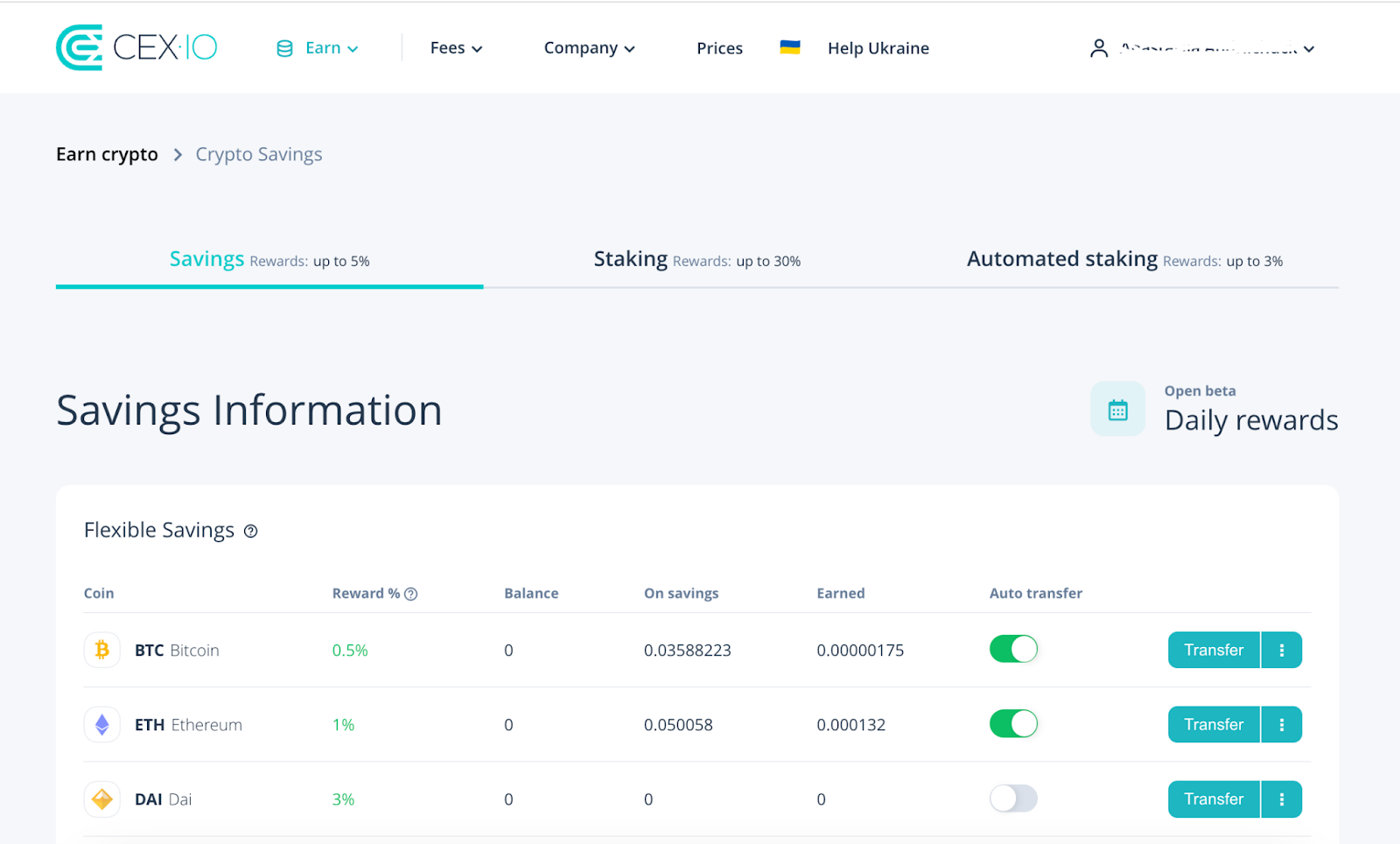

Another critical component of long-term crypto literacy is saving. This vertical can function as the bedrock for setting and knocking out future goals, or serve as a lower risk introduction to the digital asset space. Similar to staking, users in eligible jurisdictions can also choose to earn rewards by saving crypto through participating exchanges and services. This provides users who intend to HODL their assets with an additional avenue to increase their portfolios.

In crypto, “saving” is often used interchangeably with “HODLing,” or “holding on for dear life.” The term categorizes those who have long-term conviction in a specific cryptocurrency or crypto as a whole, and exercise this loyalty by retaining assets despite price volatility. However, this is different from holding assets to a crypto savings account and potentially generating rewards. Where some platforms provide automatic earn services, others require users to take specific action to become eligible for earnings. Therefore, it’s important to always read a site or service’s terms and conditions page before engaging with their offerings. Please note, CEX.IO Earn has geographical restrictions and is not available for CEX.IO users in the United States.

HODLing, on the other hand, is a passive savings strategy whereby an asset, or basket of assets, is utilized in a classic “buy low, sell high” fashion. Unlike some traditional financial instruments that lock value into prescribed blocks of time, HODLing is an informal approach that relies on individual goals and risk tolerance to attain results. To understand more about HODLing and if the strategy is right for you, check out this blog post for more information.

A good way to conceptualize how a crypto savings account could function is relative to dollar cost averaging (DCA). This is a strategy that includes buying fixed amounts of a given asset over set periods of time. For example, a theoretical participant using dollar cost averaging to purchase BTC might buy $5 worth of the coin every Monday at 3:00 PM. Similar to a traditional savings strategy where a predetermined sum from every pay period is routed to a specific account, this approach can apply to any digital asset. When utilized strategically, saving and HODLing can function as two sides of the same coin to derive value from the digital economy.

Protection

Given the long-term nature of saving and HODLing crypto, and the industry’s decentralized structure, knowing how to protect your assets is a critical piece of the crypto literacy puzzle. While many tools exist to help keep digital assets safe, shielding yourself from the possibility of harm requires the added element of vigilance. Deploying the appropriate tools and behaviors in tandem is recommended when transacting in the crypto ecosystem.

Whether you’re looking for a custodial service or prefer a more decentralized experience, consider adopting the following habits to increase your day-to-day security:

- Protect your wallet, account passwords, and seed phrases: Where some centralized exchanges will offer help in storing passwords and seed phrases, consider backing up your web3 or hardware wallets and exchange accounts in a safe place. Keeping this information private can help limit the types of exposure bad actor work to exploit. To help protect your accounts and wallets to the fullest, we recommend enabling Two Factor Authentication (2FA) protection on participating platforms. In turn, consider keeping all seed phrases in a safe or related storage.

- Read transaction messages carefully: Some web3 wallets require users to confirm transactions in a separate pop-up window before they can be executed. It is imperative to read these messages when available to ensure each transaction is set for the correct destination. Failure to do so can result in lost or stolen crypto.

- Use official products and platforms: Crypto is an exciting, emerging space, but it can also be precarious and unpredictable. To help mitigate some of this inevitable risk, only connect your web3 wallet to official platforms or protocols. While this sounds easy, bad actors will often replicate DeFi protocols and exchanges like CEX.IO to steal your assets or information. These fraudulent platforms often appear in the ad or promoted sections of search results, and have faulty or suspicious URLs. To avoid falling for these scams, consider bookmarking your favorite sites and services, or make a point to follow official sources, like CEX.IO’s Twitter account, to stay connected.

- Avoid financial fiction: There are countless examples in crypto’s past of projects that promised massive valuation only to vanish without a trace. Also known as rug pulls, these schemes often involve charismatic founders, groundbreaking technology, astronomical returns, or some combination of the three to lure in potential victims. Since these sites are often just facades for fake companies, be on the lookout for projects whose actions and/or offerings raise red flags. This can include poor quality communications, materials or products, false or unfulfilled promises, counterfeit or doctored engagement, or smart contract audits. To learn more granular details about rug pulls, check out this blog post.

While each component adds a layer of defense, together they create a web of protection to help keep your assets in and bad actors out. Now that we’ve discussed the serious and heavy weighted verticals of crypto literacy, let’s have some fun!

Spend

While much of the conversation around Crypto and DeFi is centered around financial protocols and trading strategies, the space offers a variety of vectors for leisure. Non-fungible tokens (NFTs) and GameFi are two popular ways to transact for fun in the digital asset space. However, it’s worth noting that network and gas fees can accumulate quickly. No matter how you choose to unwind on the blockchain, always keep an adequate balance to cover these expenses. In turn, the range and frequency of fees can vary tremendously between networks. In practice, this can result in a lot of smaller transactions, or complex fees that arise around specific actions.

Non-Fungible Tokens (NFTs)

Perhaps best known as unique representations of images, sound, videos, and other permutations of digital art, NFTs serve a variety of purposes on blockchain networks. They can function as digital representations of collectors items like trading cards, sports memorabilia, and, in more recent times, musical compositions and recordings. They’ve also become the primary method for forging new, digital identities on social media, and as a way to carry hobbies and interests into the digital world. This is best exemplified through the use of in-game wearables across numerous blockchain and play-to-earn platforms.

GameFi

Video games are a popular hobby for people of all ages globally. In fact, it is estimated that a large share of people spend eight to 12 hours per week playing video games. GameFi is an outlet for people to enjoy everything they love about traditional video games in the digital world. NFTs play a role in many blockchain-based video games as both in-game achievements and purchases that enhance the user experience.

Conclusion

In a changing financial environment, understanding the basic maneuvers of the digital asset space can only offer a more complete picture of the current landscape. Too often, our focus on traditional bank, savings, and retirement accounts overlooks the benefits of establishing a working knowledge of emerging verticals. But as these solutions and the communities that support them continue to grow and strengthen, new opportunities are becoming increasingly accessible for curious market participants.

Now that we’ve explored some of the many pathways that exist through the crypto space, we hope you approach decision-making with greater caution and insight. While Financial Literacy Month only comes around once a year, we recommend carrying this knowledge with you wherever your crypto journey may lead.

Disclaimer: Information provided by CEX.IO is not intended to be, nor should it be construed as financial, tax or legal advice. The risk of loss in trading or holding digital assets can be substantial. You should carefully consider whether interacting with, holding, or trading digital assets is suitable for you in light of the risk involved and your financial condition. You should take into consideration your level of experience and seek independent advice if necessary regarding your specific circumstances. CEX.IO is not engaged in the offer, sale, or trading of securities. Please refer to the Terms of Use for more details.