With the launch of CEX.IO Exchange Plus, we made a major step forward in user empowerment. Our customers can now enrich their crypto experience with deeper liquidity, and more advanced trading tools. One of these tools is Stop Limit orders, which our community has been requesting that we add for quite a while. However, for some crypto curious traders, a Stop Limit order could be an unknown beast. Since we’re all about arming users with education, in this article, we uncover the features of this order type, and in what situations users might consider using it.

What is a Stop Limit order?

As you can guess from its name, a Stop Limit order is a combination of two order types — stop and limit. A stop order is the equivalent of saying “when the price reaches X level, I want to buy/sell an asset.” In turn, a limit order could be described as a trader’s request to buy/sell crypto at a certain price, or better. As a result, setting up a Stop Limit order requires entering two price points:

- Stop level — specifies a target to trigger the potential trade.

- Limit level — defines a target to execute the order.

This means when the market price reaches the stop level, your Stop Limit order will turn into a usual Limit order, and will execute at a predetermined market rate, or better. As such, this instrument offers traders more control over the fulfillment of their orders.

A Stop Limit order example

Let’s say Bitcoin is trading near $22,000, and a trader anticipates that it will soon go down to $21,000. In addition, the trader wants to buy Bitcoin, but for no more than $21,200. In this case, they can set up a Stop Limit order, defining $21,000 as a stop level, and $21,200 as a limit level. If the Bitcoin price moves to $21,000, the order will transform into a limit one. Subsequently, as long as the order can be filled under $21,200, the trade will be completed. Once the order is filled in full, the order will be considered executed.

Wait, isn’t that a stop loss?

No, but it’s similar. A stop loss turns into a market order once the price reaches a stop level. It assures order execution, but the market rate could be far away from the desired one. On the other hand, a Stop Limit gives much greater precision, but it doesn’t guarantee order execution. A Stop Limit order can be partially filled, or not completed at all. For example, it may happen if the market has relatively low liquidity, or if the price doesn’t reach a stop level, which acts as a trigger.

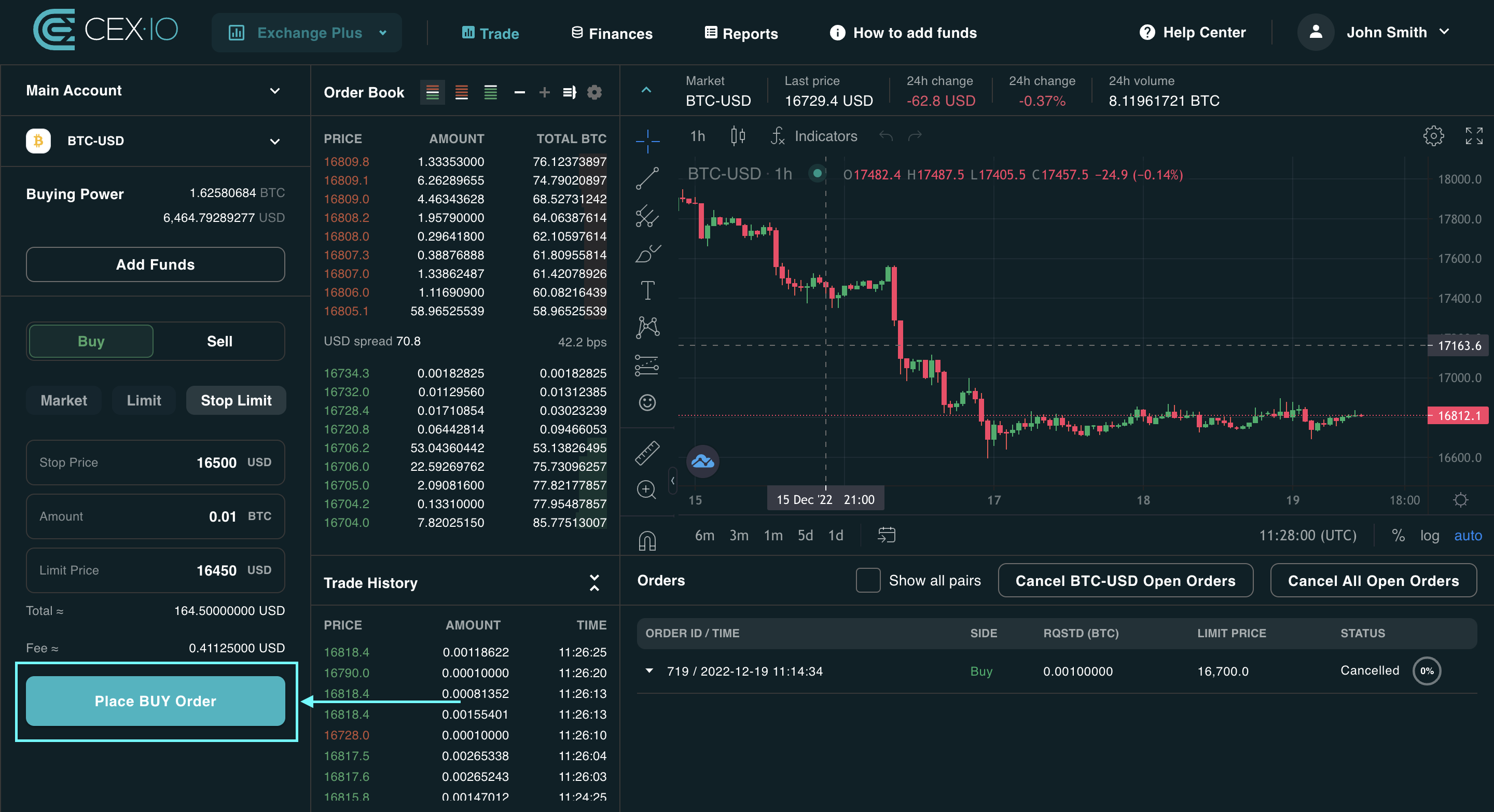

Stop Limit orders on Exchange Plus

On Exchange Plus, you can set up a Stop Limit order on the Trade page. For that, you just need to define:

- The currency pair

- Whether you want to buy or sell an asset

- Stop and limit levels

- The amount of base currency to purchase/sell

You can find a step-by-step guide on how to set up a Stop Limit order on Exchange Plus, on our Help Centre. Once you place your Stop Limit order, you will be able to check its current status in the Orders details section on the Trade page. Exchange Plus features a Good Till’ Cancel (GTC) execution principle for Stop Limit orders. This means the order will remain active until it’s fully filled, or canceled by the user.

Stop Limit order strategies

First of all, it’s important to find the balance according to your risk appetite, regardless of what strategy you use for Stop Limit orders. If you set your limit level too tight, the order could be less likely to get filled. In turn, if you set a limit point too loosely, it may lead to less beneficial trades, or even potential losses. Checking market liquidity could be helpful for defining the gap between stop and limit levels. For that, you may evaluate the situation in the order book, and analyze the general trading volume on a specific market. In addition, consider taking into account the average market volatility. Less volatile assets may have smaller gaps, and vice versa. In any case, Stop Limit orders can act as a risk management tool to protect traders from unexpected market movements. This leads us to the following strategies.

First of all, it’s important to find the balance according to your risk appetite, regardless of what strategy you use for Stop Limit orders. If you set your limit level too tight, the order could be less likely to get filled. In turn, if you set a limit point too loosely, it may lead to less beneficial trades, or even potential losses. Checking market liquidity could be helpful for defining the gap between stop and limit levels. For that, you may evaluate the situation in the order book, and analyze the general trading volume on a specific market. In addition, consider taking into account the average market volatility. Less volatile assets may have smaller gaps, and vice versa. In any case, Stop Limit orders can act as a risk management tool to protect traders from unexpected market movements. This leads us to the following strategies.

“Part-time” trader

If traders don’t monitor active orders, and the market situation, they may end up having unsuccessful trades. However, not all traders have time to keep pace with market developments. In this case, users may want to use conditional orders like Stop Limits that are executed only when specific, preferred conditions are met. This can give traders some additional peace of mind compared to basic order types. Furthermore, setting a few Stop Limit orders in advance could look like a complete trading plan. It could be executed even without the trader’s involvement, when predetermined market conditions occur.

Breakout trader

Some traders place Stop Limit orders near potential breakout points. These are typically considered major support and resistance levels, or previous key swing highs and lows. Analyzing the price chart could be useful to spot relevant levels. Liquidity is likely to increase as the price nears breakout points. Breakouts of major levels may also accelerate the established price movement. Traders may use Stop Limit orders as a potential way to take advantage of a breakout, or protect their trades from price volatility, which may occur afterward.

Momentum trader

Stop Limit orders are quite popular among day and swing traders, which typically “ride the trend” and try to catch changes in market momentum. These traders may place stop levels near price targets where momentum reversal could take place. Then the limit level is set as a preferred price to enter, or exit the market.

Conclusion

Cryptocurrencies are famous for their volatility, and typically have lower trading volume compared to traditional financial markets. But with Stop Limit orders, some of these risks could be mitigated. Stop Limit orders can help traders define preferred market conditions to buy/sell an asset. But like basic limit orders, this order type has no guarantee of being fully executed. A lot depends on the gap between stop and limit price levels that traders set up, as well as market liquidity. However, when looking to find a balance between stop and limit levels, it could be a powerful risk management tool, especially in crypto markets. Our Exchange Plus platform features deeper liquidity, empowering you to unlock new trading opportunities with Stop Limit orders. Explore this order type on Exchange Plus, and see whether it can help you improve your trading strategy.

Note: Exchange Plus is currently not available in the U.S. Check the list of supported jurisdictions here.

Disclaimer: For information purposes only. Not investment or financial advice. Seek professional advice. Digital assets involve risk. Do your own research.