- 2 in 3 traders check prices after going to bed, while 81% have stayed awake waiting for a trade or market event.

- 70% report sleep becoming harder during market drops, with 61% re-checking prices if they wake up at night.

- Nearly 70% say sleep deprivation led to a bad trade, underscoring the real financial cost of restless nights.

Crypto markets don’t sleep — and neither do many of the people trading them. According to a survey of over 1,000 active crypto traders, late-night price checks, anxiety-driven wakeups, and missed sleep due to market volatility have become routine for a large portion of traders.

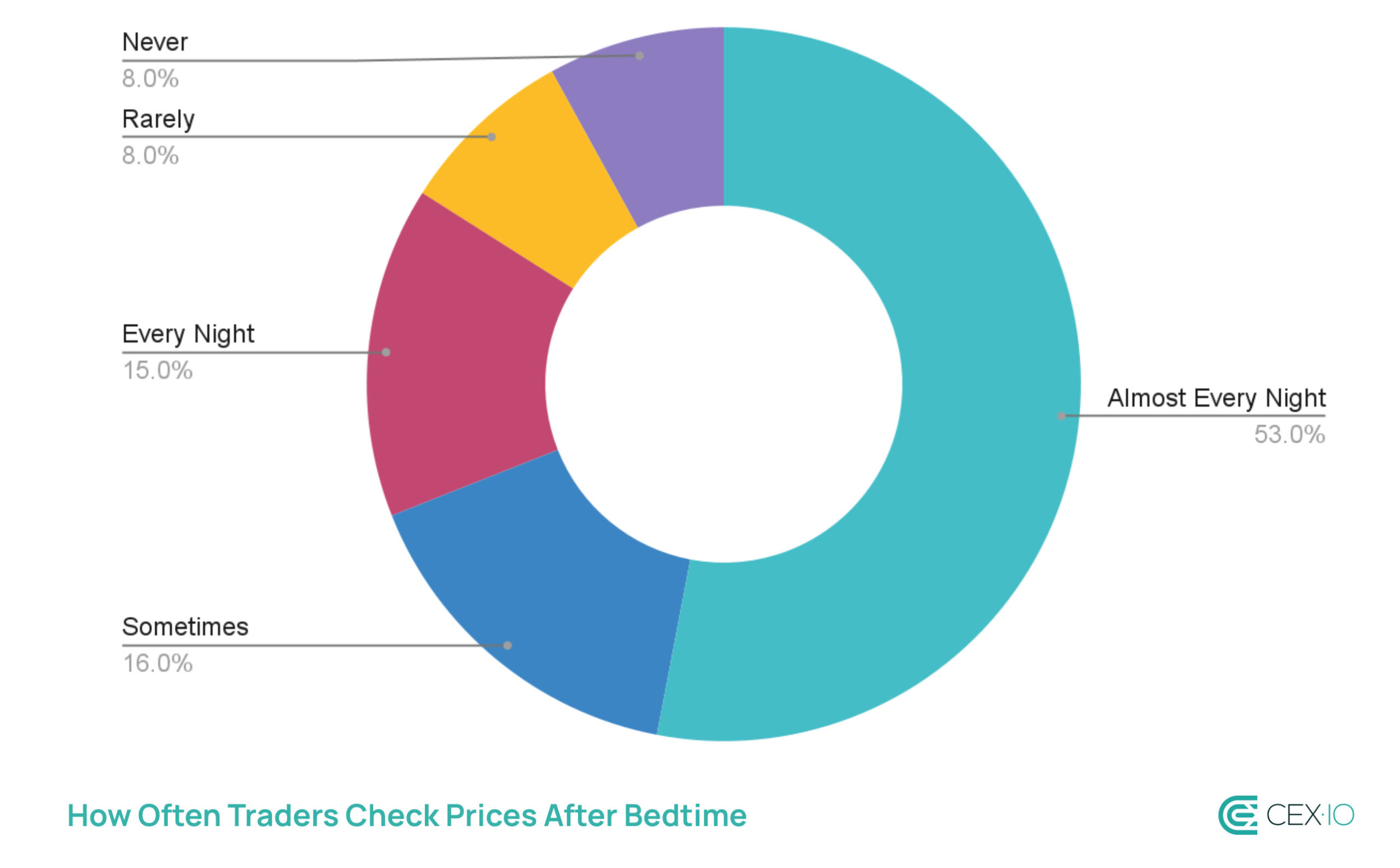

One of the clearest signals comes from nighttime behavior. 68% of respondents say they check crypto prices after going to bed either almost every night or literally every night, while only 8% report never doing so. This consistent pattern of late-night monitoring highlights how deeply market activity bleeds into daily life.

4 in 5 Crypto Traders Lose Sleep Waiting for Market Moves

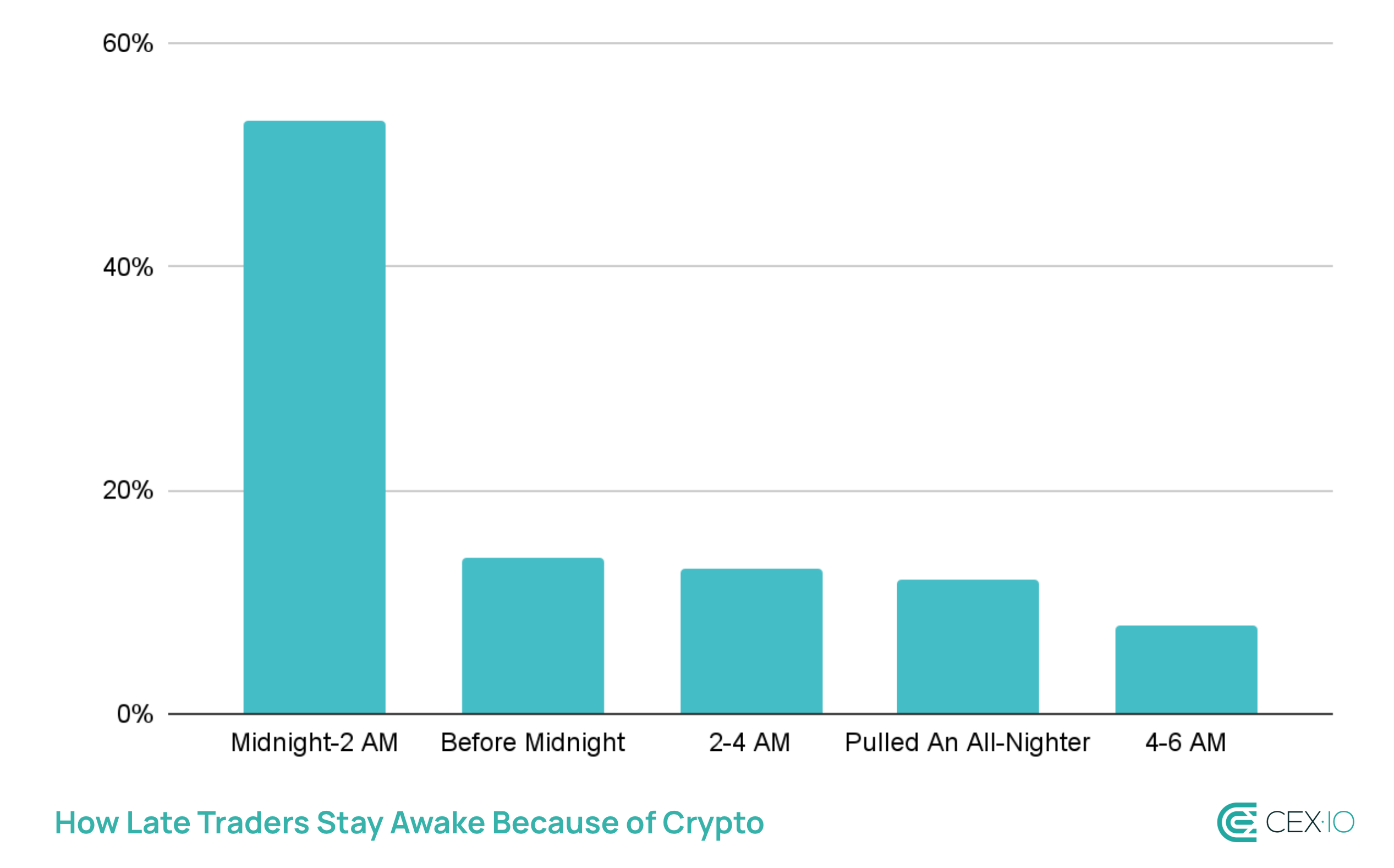

The ripple effects extend well past bedtime. When asked how late they’ve stayed awake because of crypto, 53% said they could stay up until at least 2 AM, while another 33% stay up until 4 AM or later. These habits appear to be systemic as 81% claimed to have lost sleep waiting for a good trade or an anticipated market event.

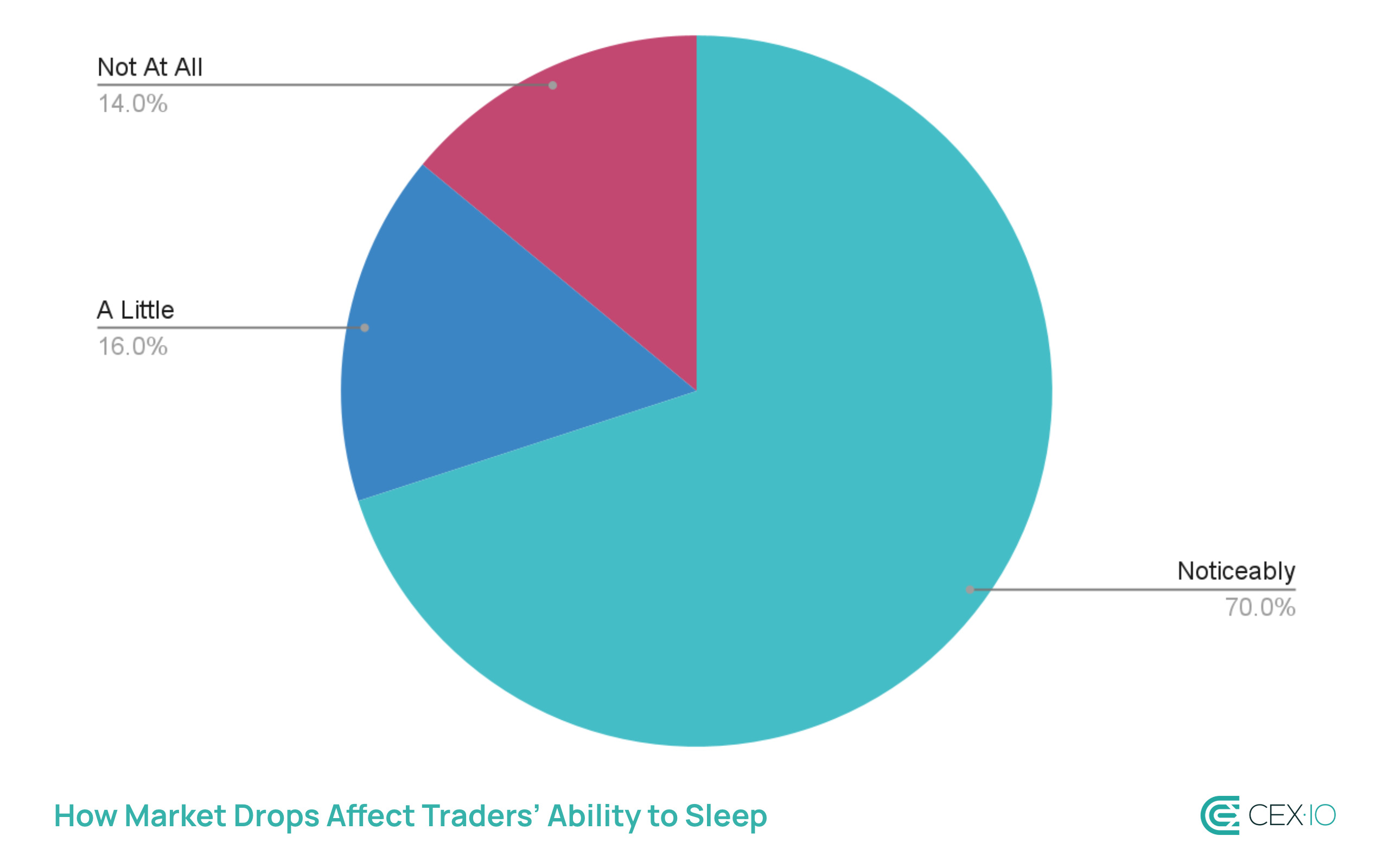

70% Struggle to Sleep During Market Drops

Market volatility is a major contributor to this behavior. 70% say market drops or liquidation risks noticeably make it harder to fall asleep, while only 14% claim to be unaffected. For many, the issue continues throughout the night — a combined 61% check prices at least once when they wake up, pointing to a loop of alerts, stress, and compulsive re-checking.

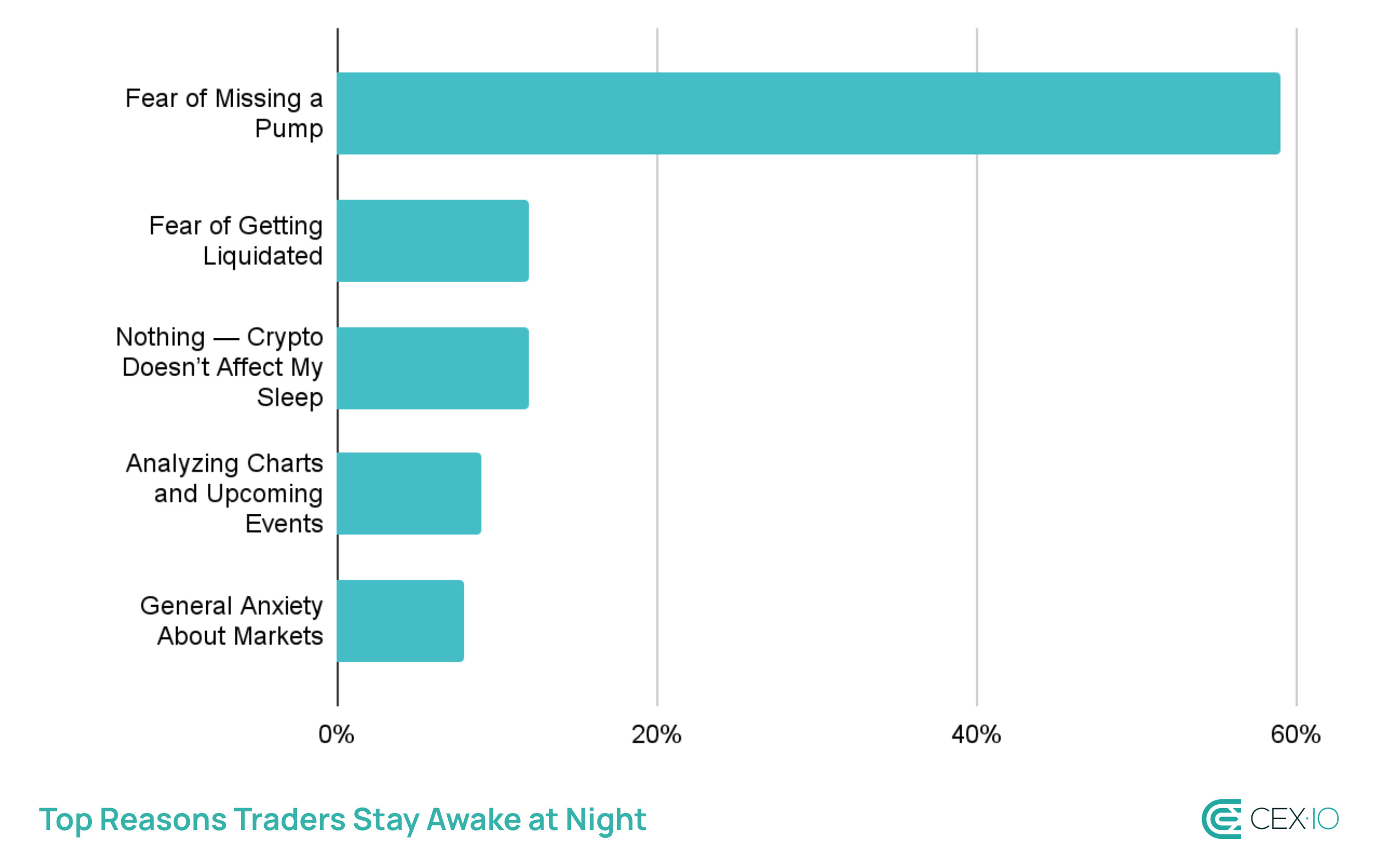

Emotional drivers play a large role. The biggest culprit appears to be not fear of loss but fear of missing out: 59% say the fear of missing a pump keeps them awake more than anything else. Liquidation risk, general market anxiety, and chart analysis follow far behind.

Recent Volatility May be Forcing Traders To Stay Awake

Such a behavior seems to be a rational reaction to nighttime volatility spikes. As such, Blockworks data shows that most spot volume still clusters between 14:00–16:00 UTC, or the professional/institutional trading time in the U.S. and EU. However, over the past two months, when the market turned bearish, the highest realized volatility spikes occurred between 18:00–06:00 UTC (grey lines) — precisely when most respondents say they struggle to sleep.

As bearish sentiment deepened, liquidity thinned outside U.S. and EU hours, creating sharper moves overnight. For traders in Europe, the Middle East, and Africa, this volatility window overlaps directly with typical sleep time, potentially amplifying anxiety and driving late-night price checks.

Chart: Realized Volatility Spikes in Crypto Market Cap (Time by UTC)

Consequences of Bad Sleep in Crypto Markets

Nearly 70% of traders say sleep deprivation has caused them to make a bad trade, and 5% admit it happens repeatedly. In high-volatile markets, the cognitive cost of exhaustion may be far higher than traders acknowledge.

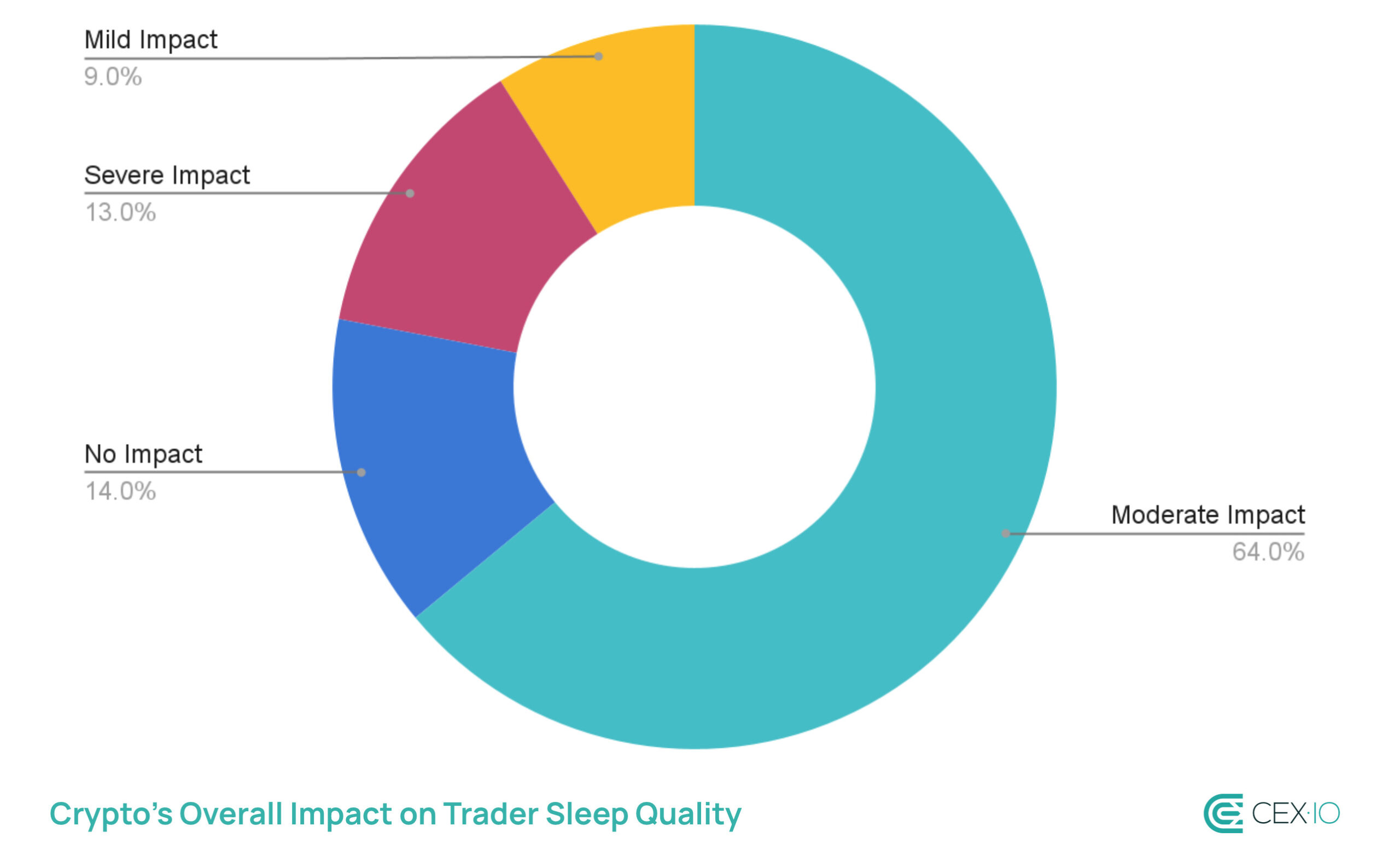

Overall, 77% of surveyed traders report at least a moderate negative impact from crypto on their sleep quality, including 13% who describe the impact as severe.

Notably, respondents overwhelmingly sleep better in bull markets (64%) than in bear markets (10%), reinforcing how deeply mood, sentiment, and price trends influence personal wellbeing.

Conclusion

With volatility increasingly shifting into nighttime hours, crypto traders may be feeling pressured to monitor moves outside working hours, eroding the boundary between markets and rest. The result is a feedback loop where stress, missed sleep, and impaired decision-making could feed into each other, creating risks that extend far beyond price charts.

The web content provided by CEX.IO is for educational purposes only. The information and tools provided neither are, nor should be construed as, an offer, or a solicitation of an offer, or a recommendation, to buy, sell or hold any digital asset or to open a particular account or engage in any specific investment strategy. Digital asset markets are highly volatile and can lead to loss of funds.

The availability of the products, features, and services on the CEX.IO platform is subject to jurisdictional limitations. To understand what products and services are available in your region, please see our list of supported countries and territories. This page includes additional links to information about individual products, and their accessibility.