In this week’s crypto highlights, we explore the price movements of ETH, SOL, ZIL, and ICP. Additionally, this recap includes other notable industry news items that occurred over the last seven days. Without further ado, let’s dive into the latest market developments.

Noteworthy market events

U.S. House Committee published a draft stablecoin bill

The Financial Services Committee of the U.S. House of Representatives released a draft bill aimed at regulating stablecoin providers. The document suggests that the U.S. Federal Reserve System should control the operations of stablecoin issuers. In particular, the agency could issue licenses for relevant activities.

Banks, and other financial institutions, wishing to issue their own “stablecoins” would have to apply with the appropriate regulator, whether at the state or federal level. The bill also seeks a study of the potential impact of a central bank digital currency (CBDC) issued by the Federal Reserve.

In addition, the document suggests a two-year moratorium on the issuance of “endogenously collateralized stablecoins,” referring to stablecoins that are backed by other digital assets or use some other mechanism to maintain their value.

During hearings held on April 19, where the bill was scheduled to be discussed, the draft bill was largely ignored in favor of a broader stablecoin debate.

The SEC filed a lawsuit against Bittrex

While preparing to wrap up operations in the U.S., Bittrex received a Wells Notice from the Securities and Exchange Commission (SEC). The regulator alleged that Bittrex simultaneously operated a “national securities exchange, broker, and clearing agency” in violation of federal statutes. Former CEO Bill Shihara and Bittrex Global GmbH are also facing charges.

SEC Enforcement Director Gurbir Grewal said the lawsuit against Bittrex “should send a message to other non-compliant crypto market intermediaries.”

The SEC also stated that six tokens that Bittrex traded are securities. They include OMG Network (OMG), Algorand (ALGO), Dash (DASH), Monolith (TKN), Naga (NGC), and Real Estate Protocol (IHT).

MetaMask users lost over $10.5 million due to an unknown exploit

MetaMask developer Taylor Monahan reported that an unidentified wallet-draining exploit took more than 5,000 ETH, and an unknown number of other tokens, from 11 different blockchains. The theft affected experienced community members who were “reasonably secure.” Monahan highlighted that “no one knows how” the exploit works yet.

According to the developer, some of the exploit’s known features are that it targets keys created from 2014 to 2022, and users who are more “crypto native” — those with multiple addresses, and who work within the space.

In response to the developer’s series of tweets, MetaMask denied claims that an exploit of its wallet is the cause of a “massive wallet-draining operation.” After that, Monahan added that the exploit wasn’t related only to MetaMask. The problem has affected “all wallets, even those created on a hardware wallet or generated for the Ethereum presale.”

Bitrue crypto exchange was hacked

On April 14, Singapore-based crypto exchange Bitrue confirmed the occurrence of a hacker attack. An unknown attacker managed to withdraw $23 million worth of ETH, QNT, GALA, SHIB, HOT, and MATIC.

Bitrue assured its users that the affected hot wallet held less than 5% of the total funds, and remaining wallets are secure. The exchange announced that it was conducting a security check, and temporarily suspended withdrawals through April 18.

Notably, attacker transactions were first performed on April 10, or four days before the Bitrue notice. The platform communicated the exploit after it was widely mentioned by on-chain investigators on Twitter, and amid backlash from its community.

One sentence news

- According to FTX’s attorney, Andy Dietderich, bankrupt crypto exchange FTX recovered over $7.3 billion in cash and liquid crypto assets, and is negotiating with stakeholders on potentially restarting operations.

- The True USD (TUSD) stablecoin was launched on the BNB Chain as a native token.

- SushiSwap prepared a redemption plan for users impacted by the RouteProcessor2 exploit last week.

- Yearn Finance, was exploited for $10 million using a flash loan attack via Aave, due to a bug in the configuration of the yUSDT token.

First Ethereum’s post-Shapella week

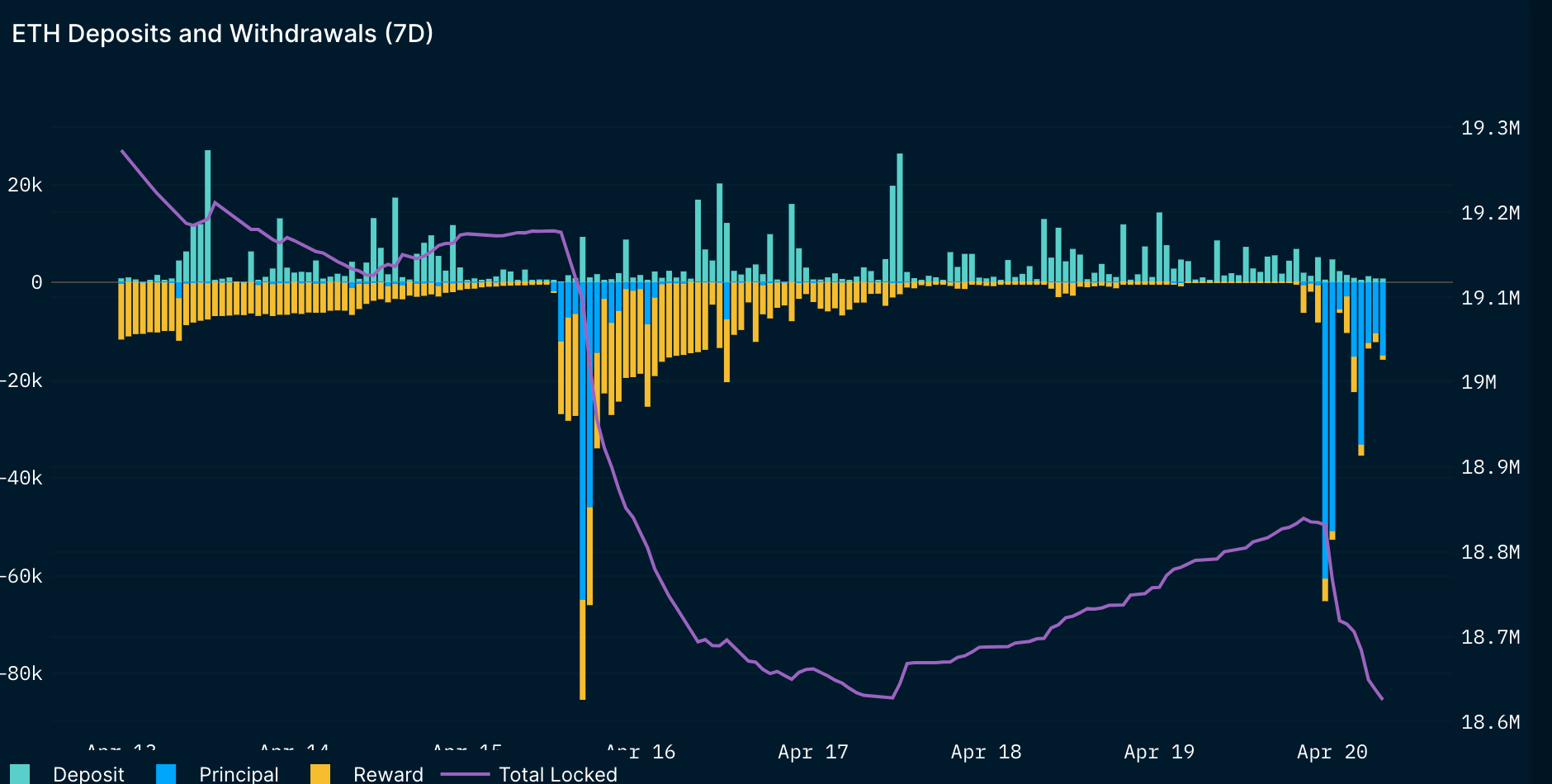

On April 12, the Ethereum network successfully completed the Shapella update, providing users with the opportunity to withdraw their staked ETH. Over 1 million ETH was withdrawn in the first four days after the hard fork. During this period, users predominantly performed partial withdrawals, meaning most of these funds were staking rewards, rather than the actual staked ETH. Kraken lead in ETH withdrawals, because U.S. regulators “asked” the platform to shut down its staking services.

Source: Nansen

From April 16 to April 19, there were spikes in deposits. Over this period, total ETH locked experienced an upward movement, meaning there were more deposits than withdrawals. This could hint that some ETH whales or institutions were waiting to see how the upgrade fared. Once they saw it progressing smoothly, they arguably jumped into the staking action.

However, on April 20, withdrawals of actual, staked ETH prevailed within the network. This move could be related to the ETH price drop on April 19. At the time of this writing, over 750,000 ETH worth $1.5 billion is waiting for a full exit. This is around 4% of the total staked ETH.

As such, during the first week of the Shapella update, Ethereum failed to experience significant sales of staked ETH, which some anticipated. According to Glassnode, most of the largest ETH stakers are still underwater, meaning they have less motivation to move.

Soon after the Shapella release, the ETH price broke the $2,000 level for the first time since August 2022, and was consolidating near $2,100 after reaching the overbought level. But on April 19, Ethereum moved below $2,000. The potential catalyst could be a Bitcoin price drop, which corresponds with an unusually large sell order on Binance, and an unexpectedly high U.K. March inflation figure of more than 10%. This caused a slight sell-off throughout the entire crypto market.

The ETH price reached the middle of the Bollinger channel on a daily chart, and the breakout point of the uptrend line (white line). The following movement could be affected based on whether or not the asset manages to protect it. If successful, the asset may retest the $2,000 level once again. If failed, it could drive the price to the $1,788 support area. MACD lines experienced a crossover (blue circle), which could support bearish momentum.

SOL is testing 20-day EMA

On April 13, Solana Labs announced that its Saga smartphone will be released on May 8, 2023, and will cost $1,000. The device will be dedicated to providing access to Web3 applications. On April 20, pre-ordered phones are scheduled to begin shipping. However, this event didn’t significantly affect the SOL price.

The failure of bulls to push the asset above the $26.8 resistance level increased bearish pressure on the market. In addition, Solana has been experiencing a gradual trading volume decrease after the January rally (white line), indicating that bullish momentum is potentially fading away.

The SOL price slipped below the 20-day EMA. Before that, the asset experienced a bearish divergence on a four-hour chart. If the asset doesn’t sustain above the 20-day EMA, it could push the price to the 200-day SMA, or even support the area near $20. However, if the price turns up from the 20-day EMA, buyers could introduce another journey to $26.8.

ZIL is moving upwards ahead of the EVM launch

Zilliqa is preparing to launch the Ethereum Virtual Machine (EVM) functionality on the mainnet, which is set to go live on April 25. After its release, users will be able to transfer native ZIL tokens using EVM-compatible wallets, and attract more developers to deploy smart contracts within the network. In addition, ZilBridge v2 was recently deployed, introducing ZIL to Arbitrum, Polygon, and BSC networks.

These are some of the catalysts behind ZIL’s upward movement throughout the last month (yellow channel). The daily RSI is in positive territory, meaning that there is still a room to continue the established trend. If the asset sustains above the 0.236 Fibonacci level, it could make another attempt to reach the $0.0365 resistance level. However, in case of breaking the ascending support line, the $0.0286 point could act as the next potential target for the price.

ICP experienced 10 green daily candles in a row

The ICP price moved up by over 20% in a week, becoming one of the best performers among the top 100 cryptocurrencies by market cap. The potential catalyst could be increased interest in ckBTC, and upcoming Ethereum integration. ckBTC is a decentralized Bitcoin-backed twin that allows on-chain BTC transactions to happen within the ICP network.

This helped the ICP price approach the $7.3 resistance level, but then the asset slightly corrected amid a sell-off on the crypto market, and due to reaching the overbought zone on a daily chart. The moving average ribbon (13, 21, 34, 55 SMAs) is experiencing a crossover (green circle). Previously, such events (white circles) hinted at the change in the established trend.

The asset moved out of the overbought level, but there is still downward potential. If the asset sustains above $6.2, it could push the price to $7.3. If failed, the $5.6 level may act as the next potential support level.

Tune in next week, and every week, for the latest CEX.IO crypto highlights. For more information, head over to the Exchange to check current prices, or stop by CEX.IO University to continue expanding your crypto knowledge.