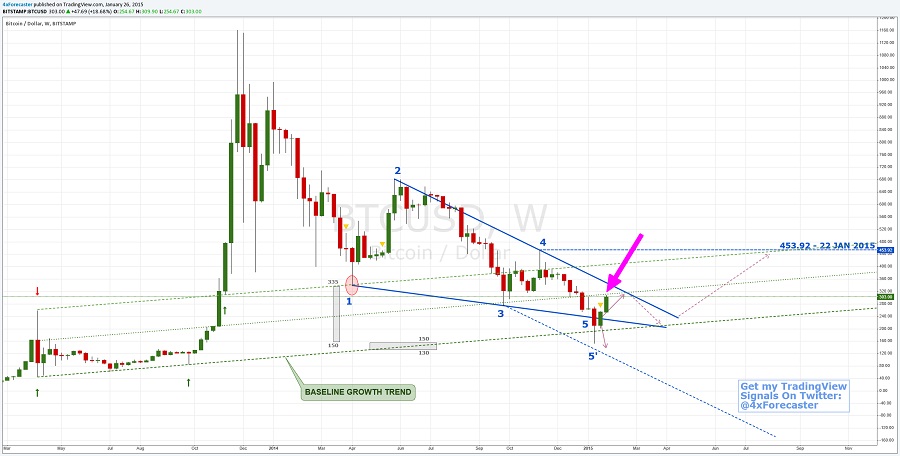

This week was an exciting mix of an unusual price run up and healthy Wall Street bitcoin money talk speculation. Are we close to a major trend reversal?

Bitcoin Price Recap

Last week, we wrapped up our forecast with bearish sentiments but, due to a series of events and news over this week and news, a short term bull opportunity presented itself as the price moved up to touch a 2 week high of $315.

Up till this high, prices had retraced up from $166 bottom – an 87% profit return for traders with long positions from this bottom. A double bottom off $166 and $195 confirmed a short-term retrace. Rebounds off significant bottoms typically occur in 2s (double) or 3s (triple) bottoms or 1 deep V channel bottom. The extent of this retracement was compounded by expectations of a highly anticipated announcement. Price went up higher than expected pausing at $232, $252 before an impulse break into $300s.

Despite an overall price decline since April, bitcoin’s price has reacted to every major news announcement with 8% + price runs. This week piece of news was different in that the market was aware of an impending announcement at exactly 9am Monday. Insiders with prior knowledge pumped bitcoin prices hours before. By the time the news came out, it was incorporated in price and what followed was a selloff.

Here is a chart of the selloff.

Yesterday (29/1/2015), prices broke down impulsively to find support at $220 level.Consecutive tests by the 30 day EMA to break over 7 day EMA line failed, resulting in this impulse down..

The market has now retraced down to 61.8% Fibonacci level. Most of this is due to profit taking. Expectations of a bear market resumption persist given the similarity of this higher magnitude corrective wave and previous corrective waves. A corrective wave forebodes a continued overall trend.

Wall Street flirts with bitcoin fundamental

This week there was plenty of news releases favoring Bitcoin’s [the blockchain] potential across mainstream financial circles. Of noteworthy mention, was a panel on Bitcoin at the largest congregation of global leaders – 20th Davos World Economic Forum in Switzerland.

The United States got its first regulated bitcoin exchange on Monday after Coinbase went live and available for trading across 24 jurisdictions! It was supposed to become the first US regulated and licensed bitcoin exchange. Later, The California Department of Business Oversight and The New York State Department of Financial Services (NYDFS) denied that Coinbase Exchange had received a license to operate in the California state.

Meanwhile, global fiat currencies continued to get hammered as investors flee into non-fiat currencies. Gold and silver broke into new 5 month highs attesting to a shift in short-term capital. With mounting anxiety in Europe regarding a possible Greek exit from the EU and a planned QE program by the European Central Bank, bitcoin as a new asset class and non-fiat currency is seemingly bullish.

The Winklevoss twins made headlines again – announcing an expected 1st quarter launch of their own similar planned bitcoin exchange — Gemini. Though still in the pipelines, the exchange is fully compliant under US regulations. Traditionally, the regulatory environment in the US has not been conducive to bitcoins progress in stark contrast to Canada for example, which has had successful bitcoin exchanges running for 4 years now.

Finally, the Wall Street Journal published a 2-page story on bitcoin and digital currencies as the future of finance and payment systems – a milestone attesting how far bitcoin has come.

“It is, quite simply, one of the most powerful innovations in finance in 500 years”.

This week’s price forecast

This week I am bearish and expect two possible bear plays. Midterm prospects are still bullish as the overall bear market nears a close and major trend reversal.

One possible count is a step lower into lows close to $166 bottom from 2 weeks ago. The current decline would gradually sell lower anywhere between current prices and $166.This would mark a double bottom bounce before retracing to test $315 and breaking past it to $450s.

This play is similar to one from August when a double test of an overall long term sloping resistance was tested once before being retested and pierced. This break of sloping resistance marked the beginning of a trend reversal to $650.

The second possible play is a continued decline to 50% retracement level (about $240 support level) followed by a bounce to break past $315 with target at $350s.

A pull back a bit to $266 (a major support level) to digest the sharp rise in prices. And then we will stand firmly above $300 in the mid-week, finally touching $350 by the end of the week.

In both moves, a bottom is on the horizon. The bottom at $166 had significant volumes as illustrated here. Particularly, high volumes on capitulations were accompanied by a second bottom with lower volumes followed by a trend reversal as in April. These are the last weak hands to be shaken out before a major trend reversal.

Basically, I do not think the bottom is in.