Key Findings:

- Stablecoin supply grew 49% in 2025, adding over $100 billion and reaching the largest stablecoin dominance in crypto market cap since 2023.

- Ethereum and Tron’s combined market share declined from 85% to 80% as BSC and Solana captured most of the new stablecoin supply momentum.

- USDC has been eating up smaller stablecoins in DeFi interaction and on-chain transfers, while USDT saw increased dominance in trading volume, reaching 82.3%.

- Stablecoins reached $33.4 trillion in aggregated trading volume in 2025, showing a 29% increase compared to 2024’s performance.

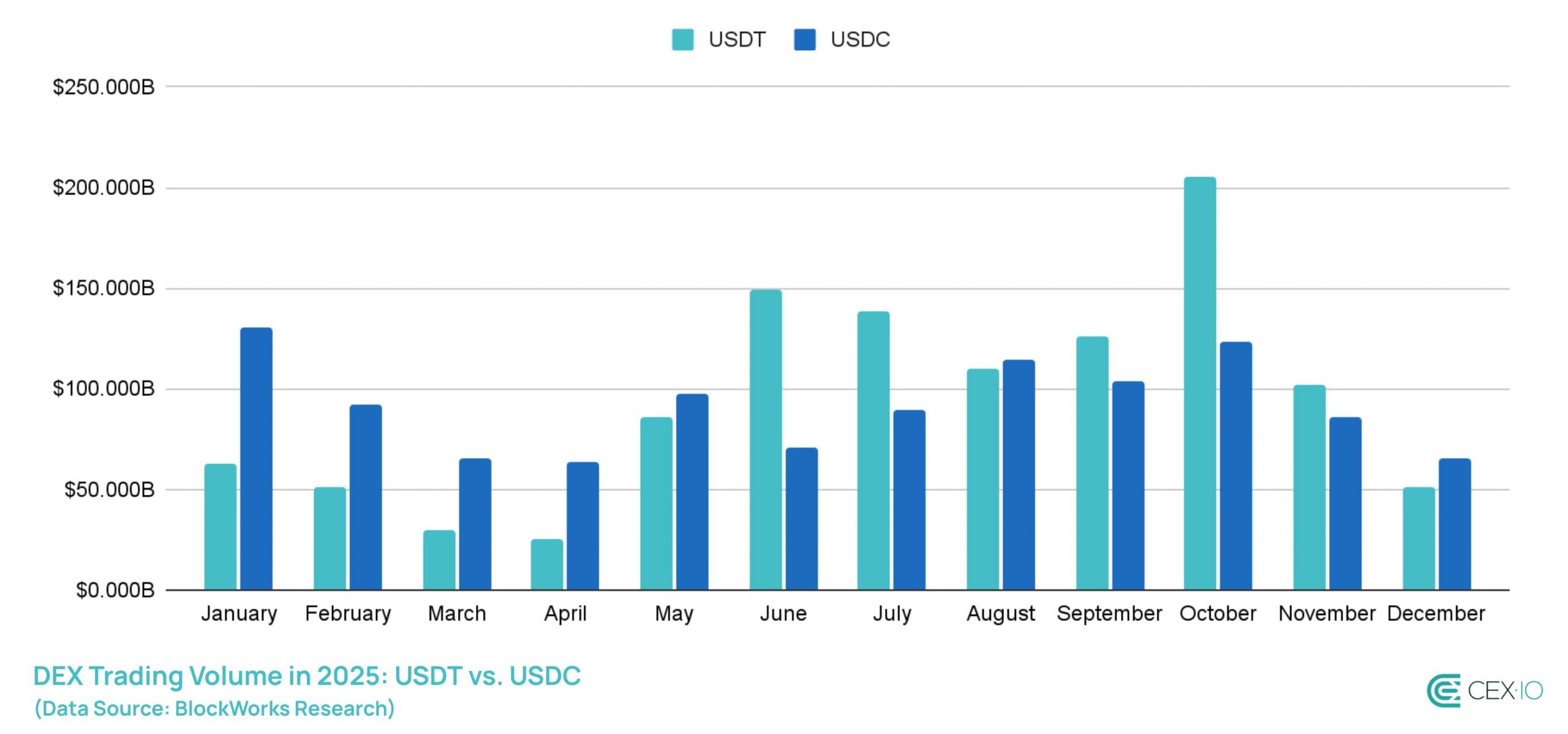

- In 2025, USDT’s DEX trading volume exceeded USDC’s for the first time since 2021.

In 2025, stablecoins accelerated their transition from crypto-trading tools to a legitimate global settlement layer. This move was anchored by landmark regulatory progress, including the U.S. GENIUS Act and MiCa’s implementation in Europe, which established the first comprehensive federal frameworks for stablecoin issuers.

TradFi adoption experienced a significant boost as giants like Stripe and PayPal integrated stablecoins directly into mainstream commerce. The market also saw the rapid rise of high-impact new entrants, most notably USD1 backed by the Trump family and USDG supported by Robinhood, Kraken, and Paxos.

The convergence of regulatory clarity and institutional adoption created conditions for stablecoins to achieve a level of legitimacy that would have seemed impossible just years earlier. To explore the further trajectory of stablecoin market, let’s dive into the sector’s current health and major changes in its landscape that defined the past 12 months.

Supply Dynamics

Total Supply Growth

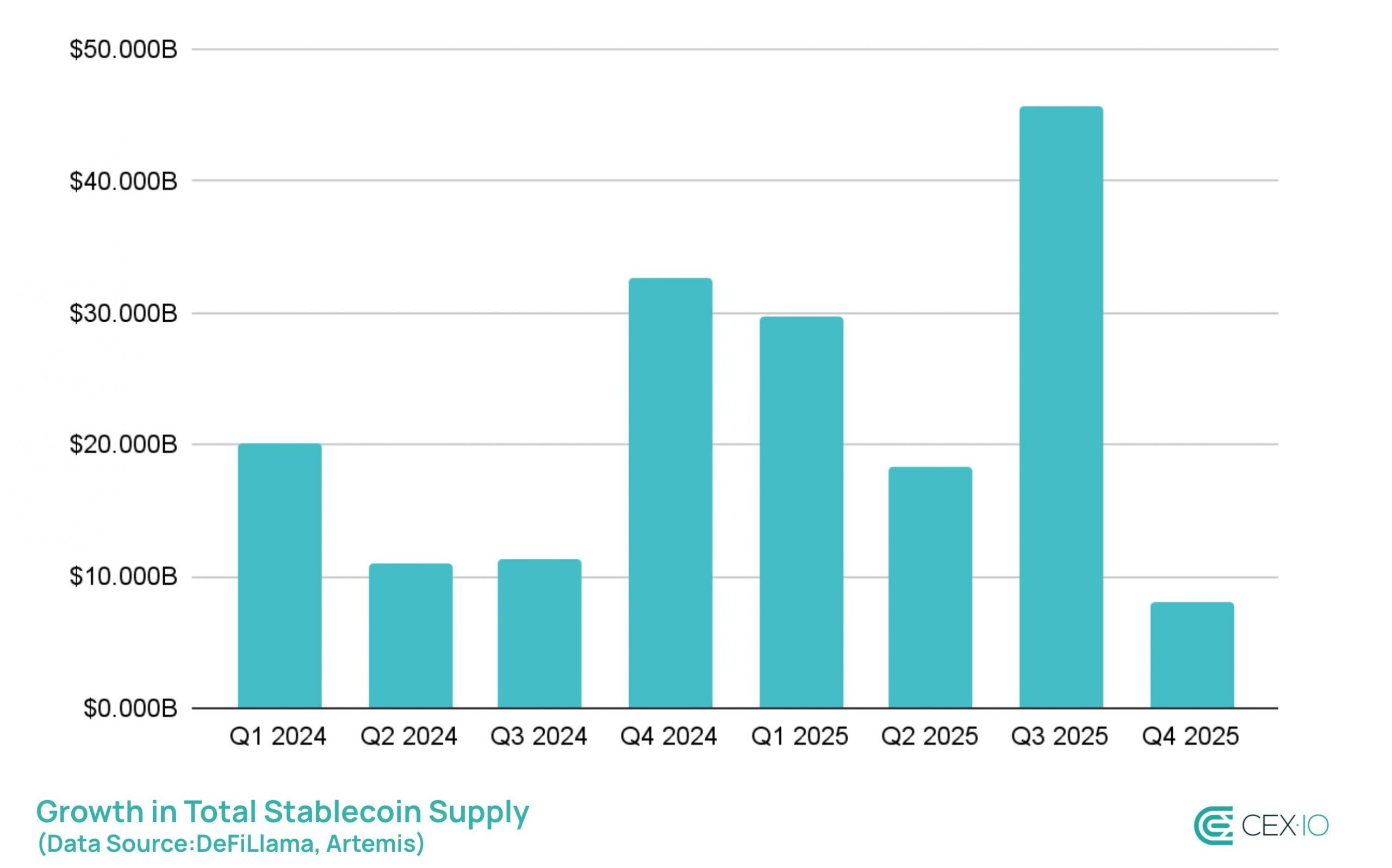

In 2025, total stablecoin supply increased by over $100 billion, or 49%, in the year, surpassing the $300 billion mark. The expansion was particularly pronounced in the third quarter, where stablecoin supply increased by $45 billion, which is the largest stablecoin expansion in its history.

However, in Q4, it was only $8.1 billion, marking the worst result since Q4 2023. The latter was primarily affected by the increased risk off sentiment and a 22% drop in crypto-backed stablecoin supply.

As such, stablecoins now account for nearly 9% of total crypto market cap, up from 6.4% at the beginning of 2025. Such a rise in stablecoin dominance is quite unusual as stablecoin supply has been historically strongly correlated with crypto market cap, registering 0.8-0.91 in 2020-2022.

However, in 2025, the correlation between crypto market cap and stablecoin supply was only 0.4, which suggests that the sector’s growth was less associated with the waves of crypto bull and bear markets than in the previous cycle. Instead, stablecoins have been establishing themselves more as independent financial infrastructure with sustained demand regardless of market cycles.

Another notable milestone is that stablecoins now represent approximately 1.38% of total U.S. dollar supply, up from 0.95% at the beginning of 2024, highlighting their growing significance in the global financial system.

Supply Growth By Asset

Most of this $100 billion net supply growth in 2025 came from 7 stablecoins, 3 of which — USD1, USDf, and USDG — were launched last year.

Leading Stablecoins

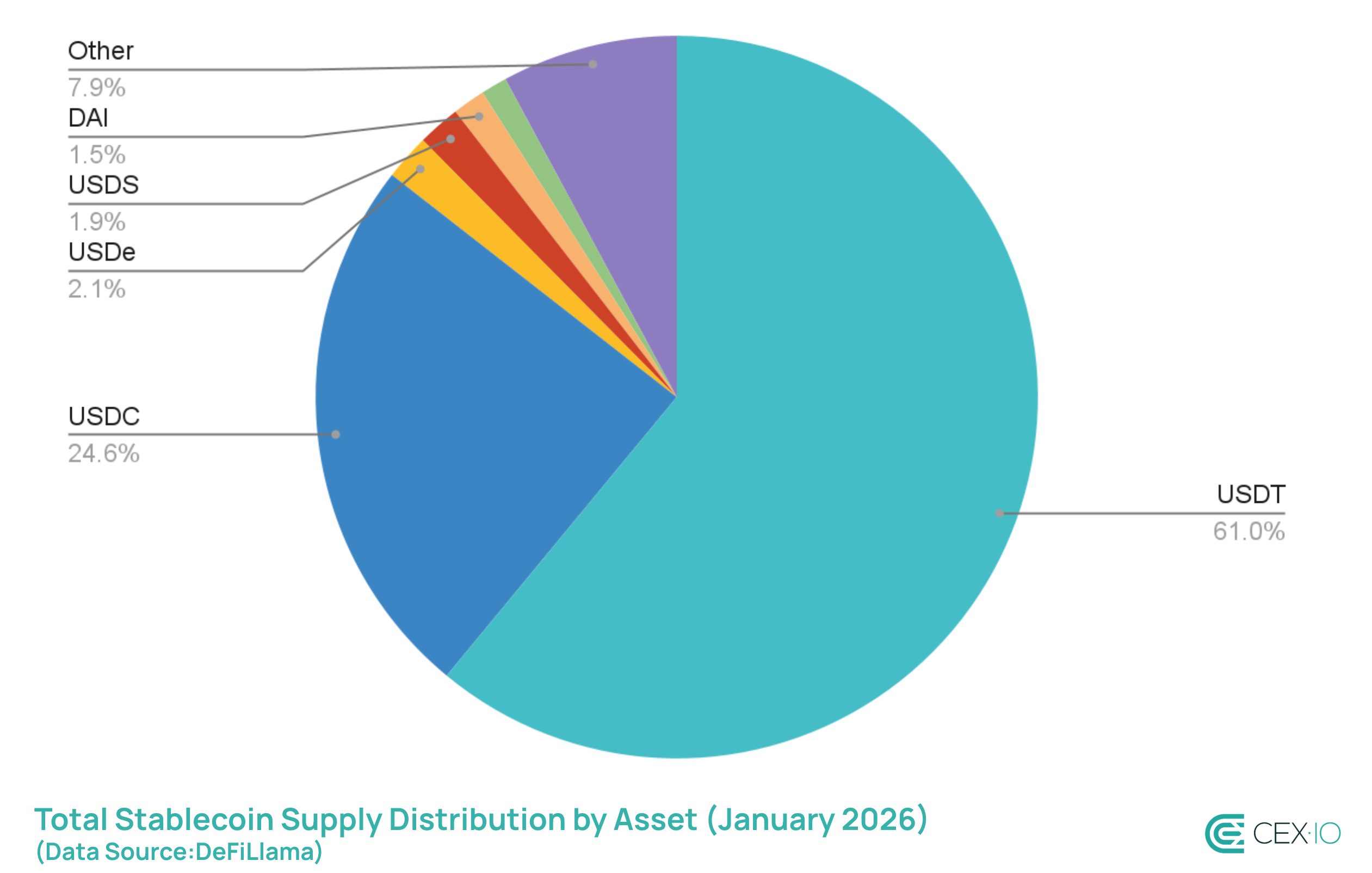

USDT maintained its position as the largest stablecoin, growing by $49.7 billion in 2025 and hitting $187 billion in total supply. While impressive in absolute terms, USDT’s market share in total stablecoin supply actually showed slight erosion, moving from 67% to 61%, as USDC and newer entrants captured a portion of the expanding market.

USDC was the second-largest contributor to supply growth, adding $31.4 billion to reach $75.3 billion by year-end. This growth was partly driven by USDC’s continued domination in DeFi and its regulatory compliance advantages in traditional payment integrations. As a result, USDC’s share in total stablecoin supply increased from 21% to 25%.

Emerging Players

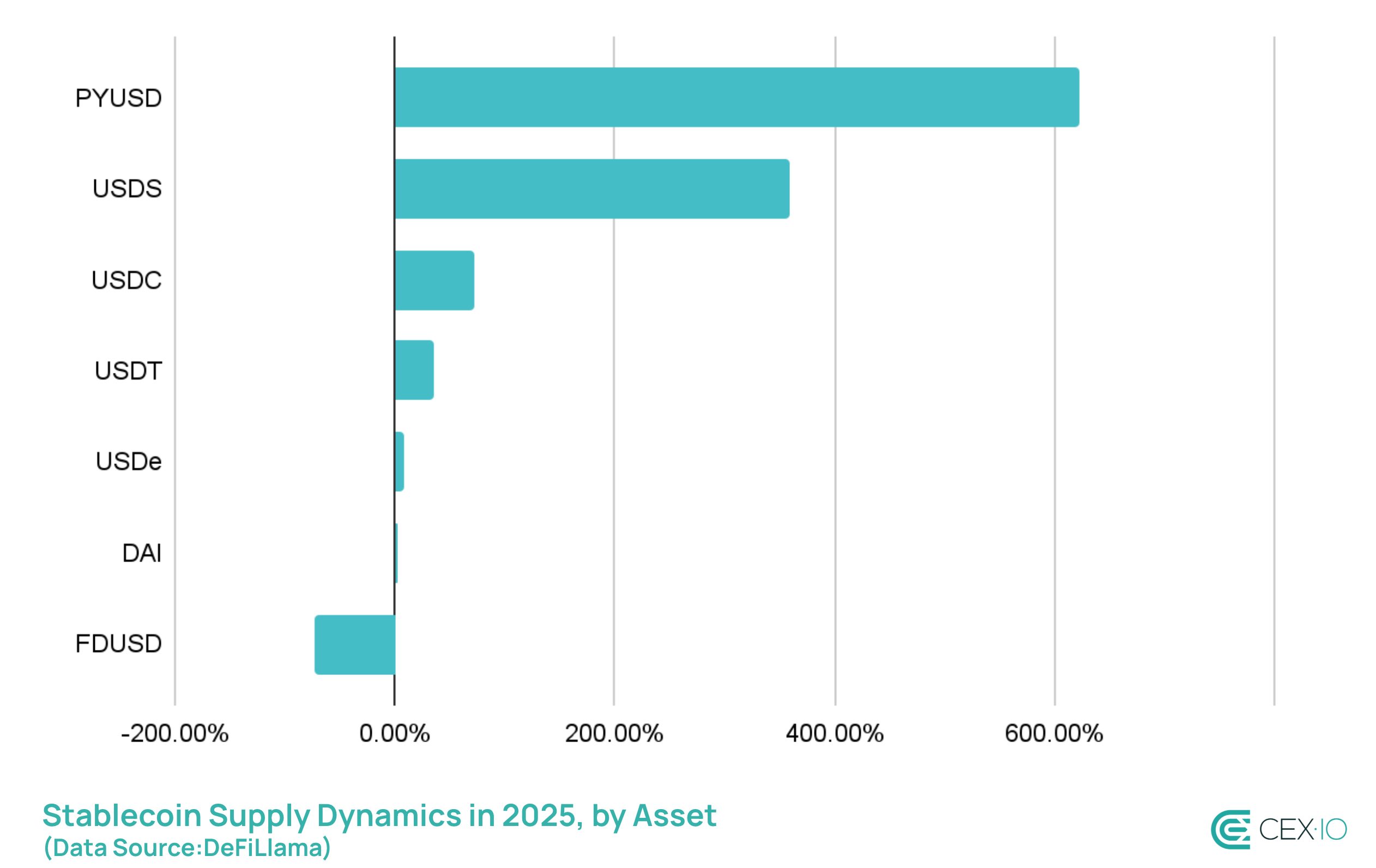

PYUSD emerged as one of the year’s biggest success stories, with supply skyrocketing by 623% to $3.6 billion. This explosive growth was fueled by PayPal’s aggressive expansion strategy in the space and integration across multiple blockchain networks.

USDS, the upgraded version of DAI, also grew substantially to $5.9 billion, up 358% from its levels at the beginning of 2025. The major contributor to this surge was sUSDS, which in a matter of months dethroned sUSDe and BUIDL, becoming the largest yield-bearing stablecoin.

Among the year’s new launches, USD1, USDf, USDG all established meaningful market presence, each surpassing $1 billion supply in less than a year.

In general, new entrants represented a broader trend toward traditional finance companies entering the stablecoin space, with PYUSD and USDG viewed as part of a growing TradFi-backed cohort bringing institutional credibility to the sector.

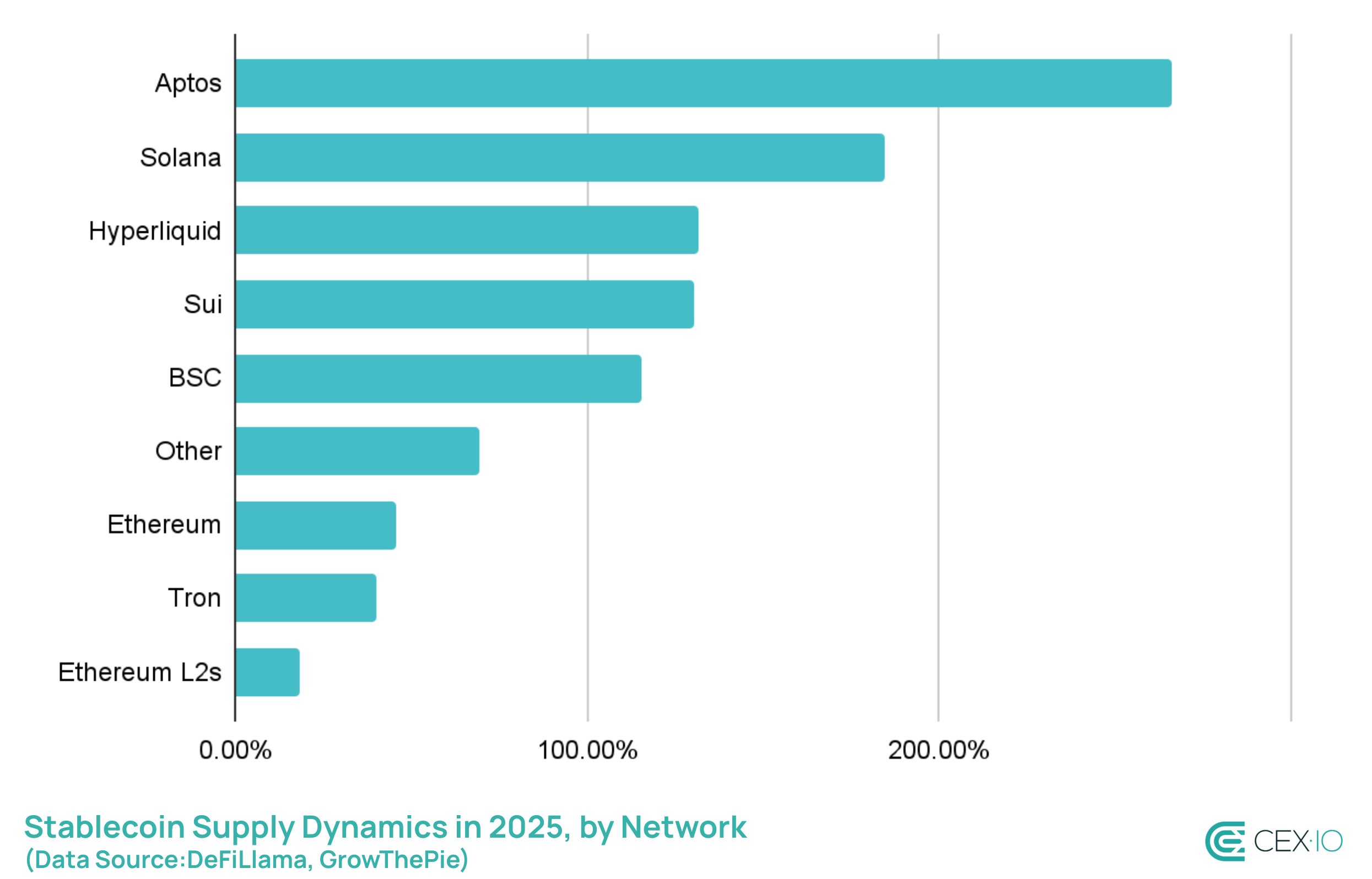

Supply Growth By Network

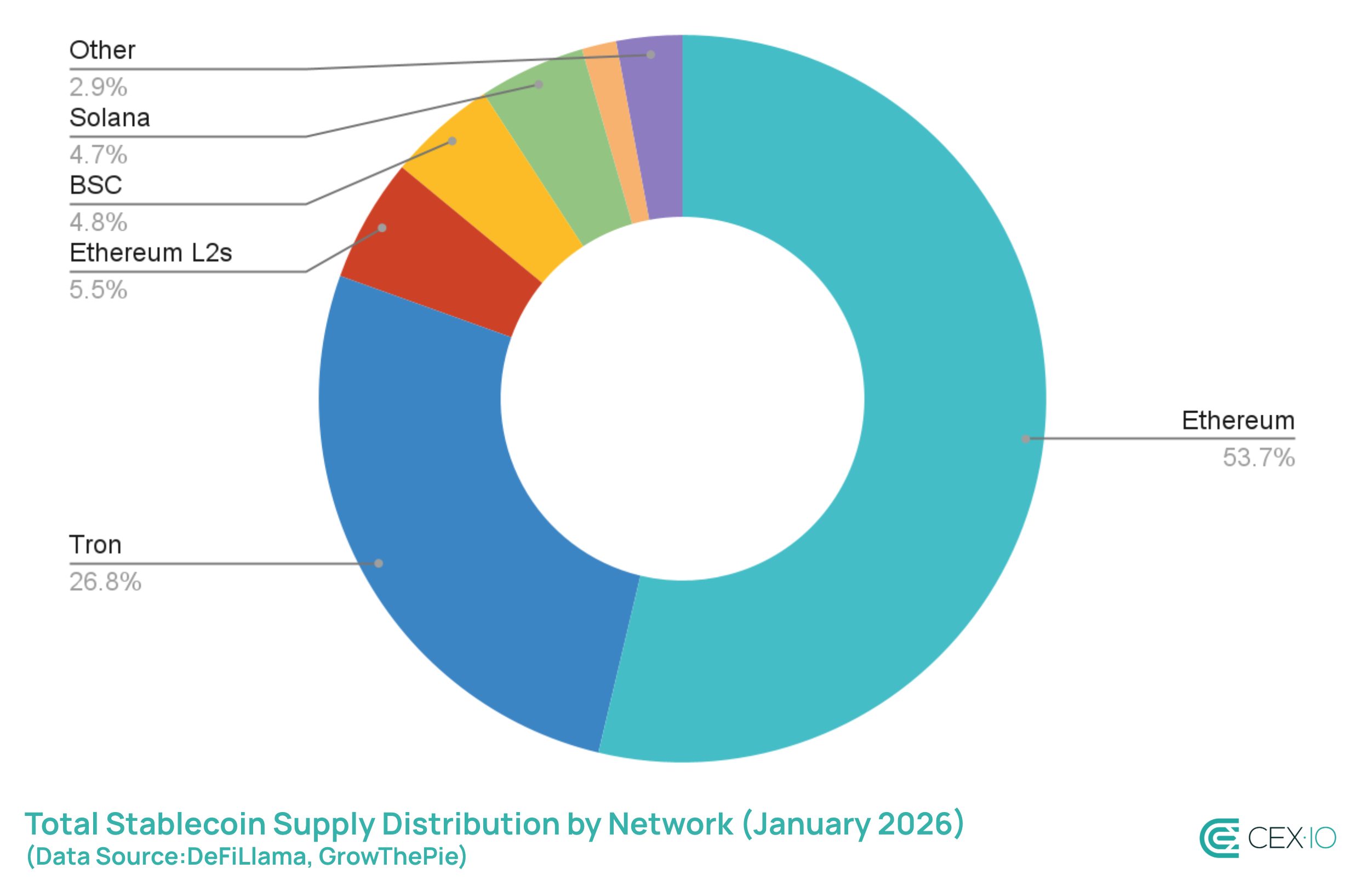

In terms of network distribution, 74% of stablecoin supply growth came from dominant networks such as Ethereum and Tron. However, the stablecoin landscape continued the diversification trend of 2024, as both networks saw their share of total supply decline in 2025.

Dominant Networks

Ethereum captured the largest share of new stablecoin issuance throughout the year, adding more than $51 billion in total supply. This L1 growth was partly fueled at the expense of Ethereum’s L2 networks, which saw only a $2.6 billion stablecoin expansion and a declining share in total stablecoin supply.

The most impactful factor has been an over 98% drop in mainnet fees throughout 2025. With gas prices hovering at historically low levels, Ethereum L1 became more cost-competitive with many L2s. Notably, most of Ethereum’s gains in stablecoin supply occurred during declining fee periods.

Tron maintained its position as the second-largest network, adding $23.6 billion in stablecoin supply. However, since cost-efficiency was Tron’s one of the main competitive advantages for a long time, it has been losing its dominance in 2025 to faster-growing alternatives with lower fees.

Overall, a combined share of Ethereum and Tron in total stablecoin supply decreased from 85% at the beginning of 2025 to 80% in early 2026, with BSC, Solana, and Hyperliquid capturing the most of new stablecoin supply momentum.

Rising Stars

Among smaller ecosystems, Solana and BSC gained the most in absolute numbers, each adding nearly $15 billion in stablecoin supply. Both networks saw spikes in stablecoin supply amid local memecoin frenzies to support the momentum, with stablecoin activity primarily landing on DEXs.

Over time, Solana managed to significantly decrease its memecoin dependency, with SOL-Stablecoin and stablecoin swaps becoming a primary source of DEX activity. However, BSC remains memecoin-heavy, with the surged stablecoin supply also finding its use in yield farming, lending, and on-chain transactions. Notably, BSC dominated in active stablecoin addresses throughout 2025.

Aside from Solana and BSC, Aptos and Hyperliquid were among the fastest growing stablecoin ecosystems, registering 266% and 131% jumps in stablecoin supply, respectively.

The rise of newer networks like Aptos, Sui and Hyperliquid, combined with the continued growth of Solana and BSC, points to an increasingly multi-chain future for stablecoins, where users select networks based on specific use cases rather than defaulting to established options.

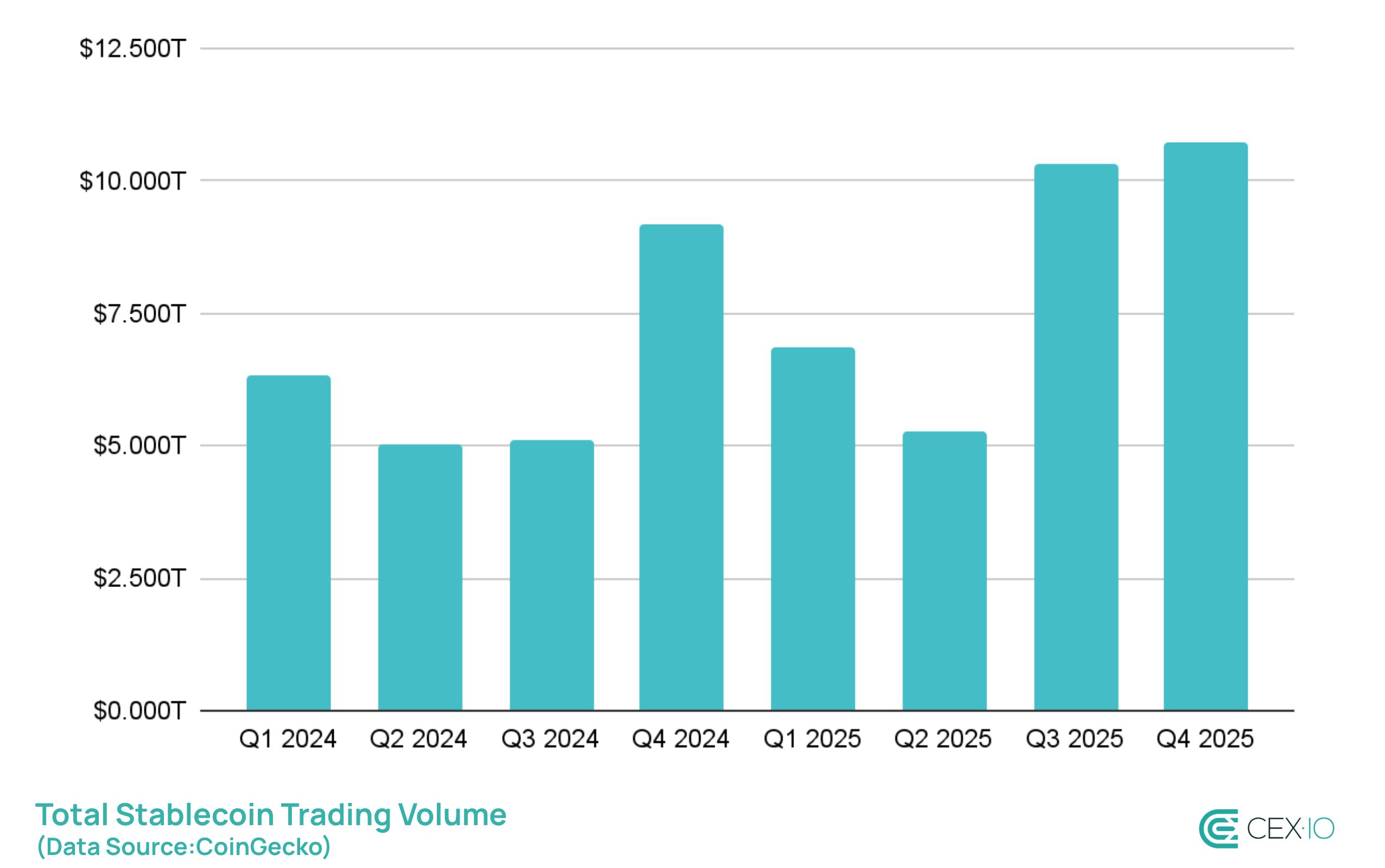

Trading Volume Dynamics

Total Volume

Stablecoins reached $33.4 trillion in aggregated trading volume in 2025, representing a 29% increase compared to 2024’s performance. Despite this substantial growth, the sector still fell slightly short of the record $35 trillion achieved in 2021, when the bull market drove unprecedented trading activity across crypto markets.

Average daily trading volume across 2025 stood at $91.5 billion, up from $70.6 billion in 2024, reflecting the sector’s sustained role as the primary medium of exchange for crypto trading, with most activity taking place in the second half of the year.

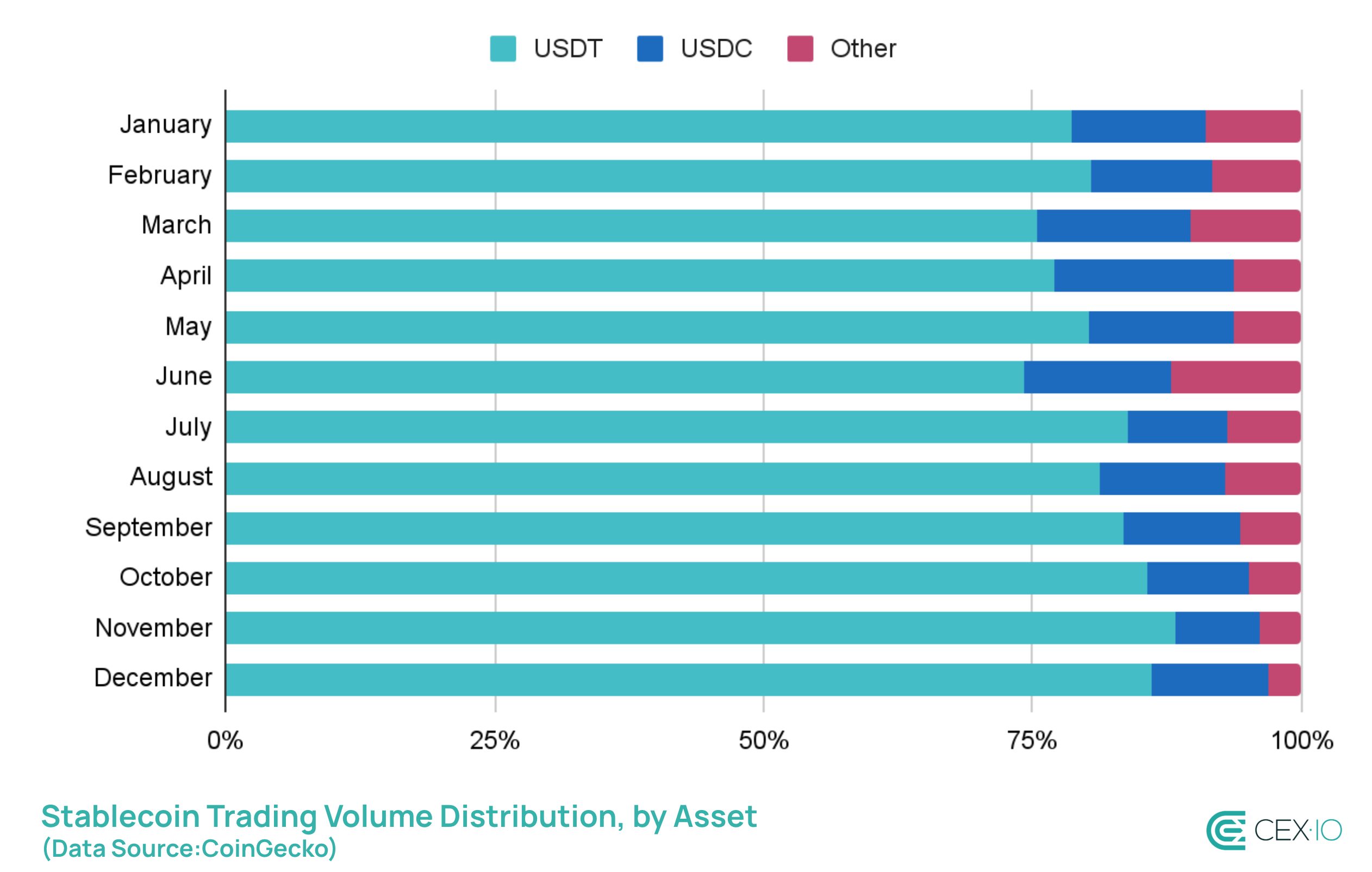

The Rising Dominance of USDT

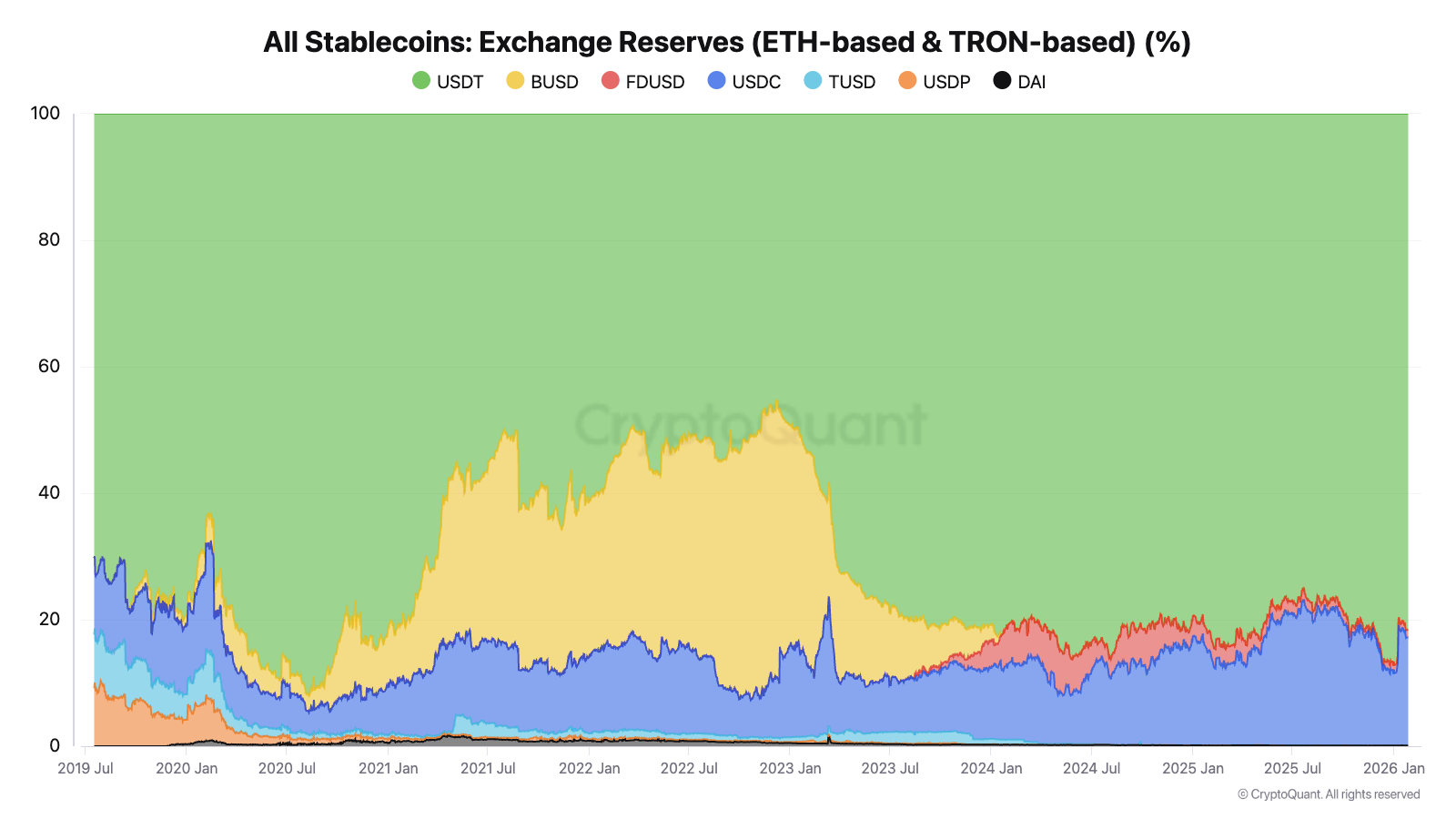

Perhaps the most notable trend in 2025’s trading landscape was USDT’s increasing concentration of trading volume. For the full year, USDT accounted for 82.3% of all stablecoin trading volume in 2025, up from 79.6% in 2024. In turn, USDC captured 11.2%, while all other stablecoins combined represented just 6.5%.

This USDT concentration intensified throughout the year, moving from 78.5% in January to 86.0% in December. This rise in domination occurred, despite USDT delisting for EU customers on multiple CEXs, as markets became more concentrated during US trading hours.

The trading volume concentration toward USDT was further reinforced by exchange reserve patterns. Throughout 2025, stablecoin reserves on centralized exchanges grew by 23%, surpassing $70 billion.

However, this growth was overwhelmingly driven by USDT, which saw reserves surge by 34%, while most other major stablecoins experienced declining exchange reserves. FDUSD experienced the most impactful drop, losing half of its exchange reserves and 83% of its trading volume in 2025.

The DEX landscape reveals another dimension of USDT’s growing influence. Historically, USDC had dominated DEX trading, leveraging its strong integration with DeFi protocols and preference among on-chain traders. However, 2025 marked a turning point. For the first time since 2021, USDT’s DEX trading volume exceeded USDC’s. USDT recorded $1.14 trillion in DEX volume compared to USDC’s $1.10 trillion.

USDT volume on DEXs surged by over 285% compared to 2024, with nearly 4% of all USDT volume taking place on decentralized exchanges. In turn, USDC saw its DEX share decline from 39% in January to 23% in December. This suggests that while USDC has become increasingly adopted by CEXs, the gap on DEXs was primarily filled by USDT. The major contributor to this shift was BSC network, which saw a 4x increase in DEX volume and primarily featured USDT for transactions.

The increasing concentration of trading volume around USDT indicates that traders are using the path of least resistance for order execution due to its unmatched liquidity depth and widespread support. However, this concentration raises questions about market resilience and competition. As USDT’s dominance grows, alternative stablecoins face steeper challenges in gaining trading traction, even if they may offer regulatory advantages or innovative features.

2026 Outlook

Many of the defining trends of 2025 transitioned from 2024 and are poised to accelerate in 2026. For instance, the diversification of supply toward newer, smaller networks shows no sign of slowing, with these emerging ecosystems continuing to chip away at the dominance of established players.

Stablecoin regulation will likely continue to take shape globally, with Singapore preparing a draft stablecoin legislation and UK consulting on a market framework for stablecoins. Also, the global regulatory landscape may find further clarity in Q1 2026, as FATF is set to release its report on stablecoins.

Traditional finance’s push into the sector could also intensify this year as stablecoins become the “invisible” back-end for everyday fintech. PayPal, Klarna, Robinhood, Stipe, and Revolut have big plans in 2026, while Visa and Mastercard have both announced plans for stablecoin settlements this year and expect the trend to accelerate next year..

However, the sector’s performance in 2026 remains tied to the broader crypto market. While stablecoins proved more resilient during the market volatility of Q4 2025, their supply growth still largely mirrors the industry’s overall health. A deeper market correction could pressure growth and limit new supply, while a reestablished bull market would likely act as an aggravating factor, pushing stablecoin adoption and total supply well beyond current projections.

Sources

The report utilizes a diverse range of trusted sources, including DeFiLlama, Artemis, The Block, Visa/Allium, CoinGecko, CryptoQuant, Blockworks Research, and GrowThePie. These platforms provided key metrics on supply and trading dynamics to validate market developments across fiat- and crypto-backed stablecoins. The observation period for this study was focused on 2025 annual performance, with data points ending January 1, 2026.

The web content provided by CEX.IO is for educational purposes only. The information and tools provided neither are, nor should be construed as, an offer, or a solicitation of an offer, or a recommendation, to buy, sell or hold any digital asset or to open a particular account or engage in any specific investment strategy. Digital asset markets are highly volatile and can lead to loss of funds.

The availability of the products, features, and services on the CEX.IO platform is subject to jurisdictional limitations. To understand what products and services are available in your region, please see our list of supported countries and territories. This page includes additional links to information about individual products, and their accessibility.